Domaine Dujac, Chambertin, 2008

Main reasons to invest

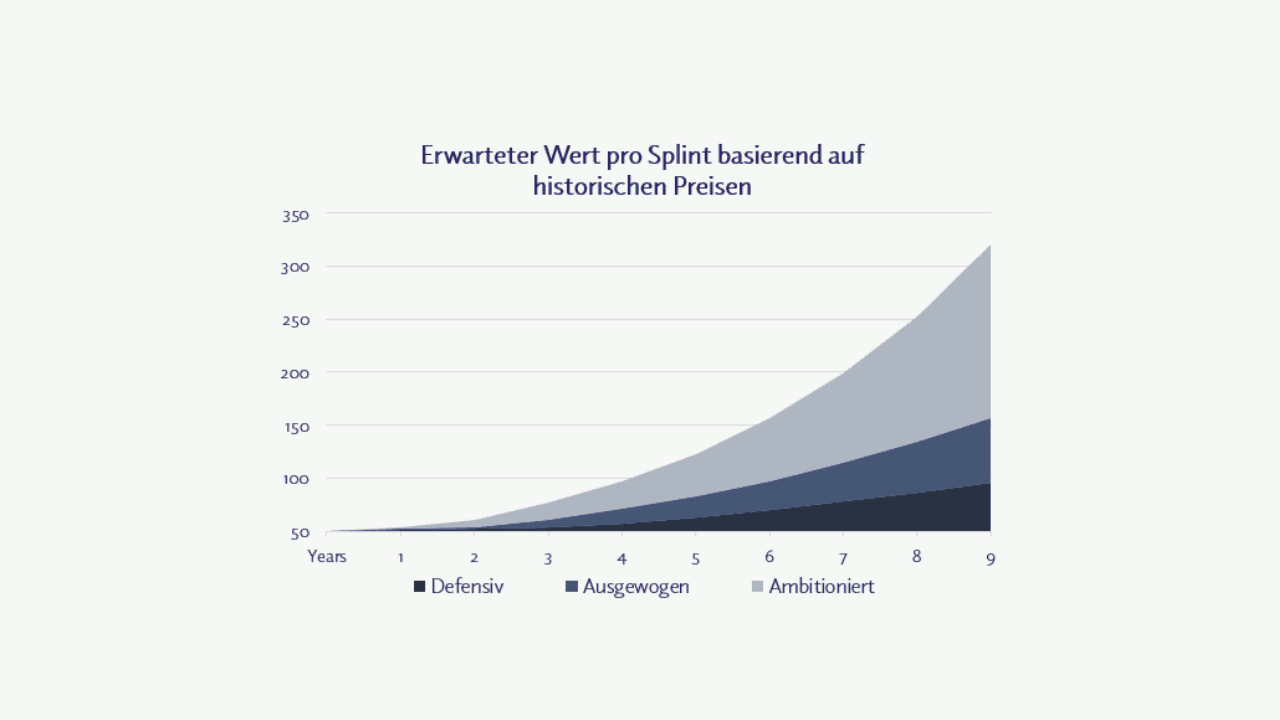

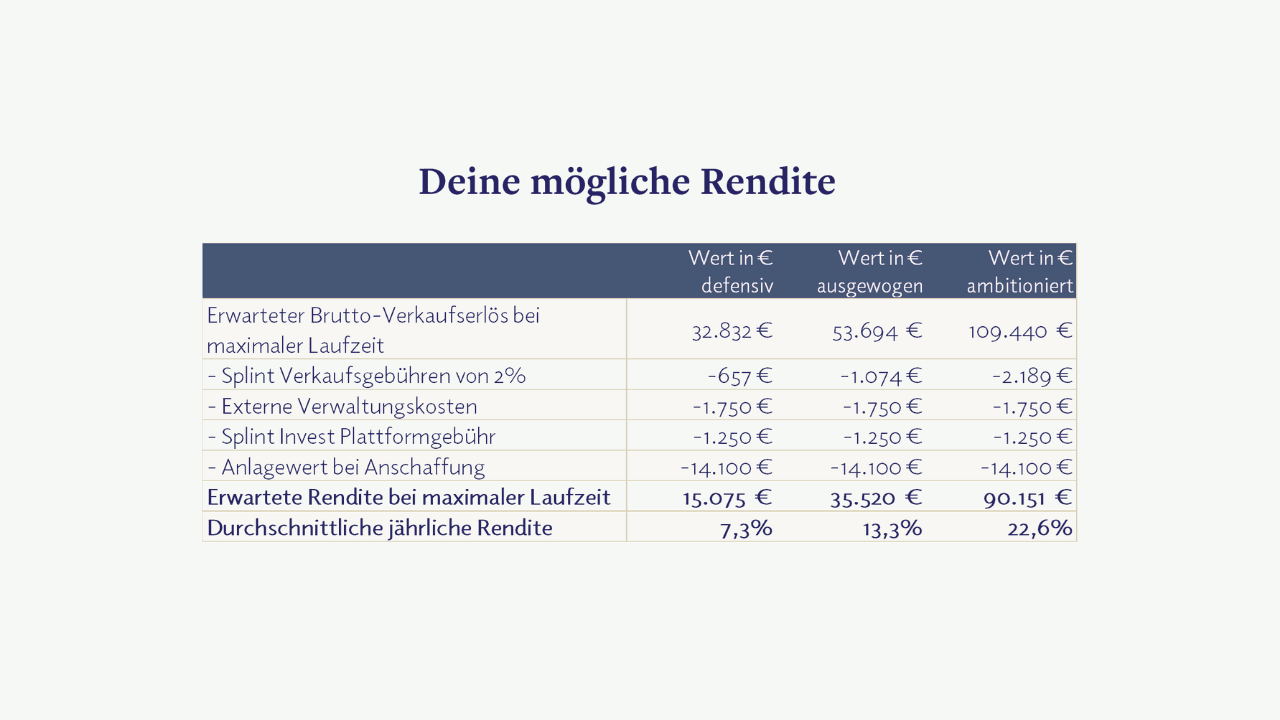

The Chambertin from the house of Dujac has given investors a return of 12-49% in less than 20 months.

The Chambertin-production volume of Domaine Dujac is extremely limited. On their 0.73 hectares, they produce about 1,500 bottles a year.

The 2008 vintage receives an average of 95.2 points from the three most important wine critics, which underlines the quality of the winery.

Description

Burgundy drought for wine lovers seems inevitable. The French Ministry of Agriculture highlighted that the 2021 was worse than the 2020 harvest.

The wine exchange Liv-ex recently published an article on Burgundy 2020, writing that 1.23 million hectoliters of wine were produced in Burgundy in 2019. In 2020, it was 1.56 million, and production is expected to be 900-950,000 hectoliters in 2021. This is a significantly reduced supply, which, combined with increasing demand, creates a lucrative scenario for wine investors - both for Dujac and Burgundy in general.

Expert

RareWine Invest is Scandinavia’s largest provider of investment wine. Clients benefit from more than 15 years of experience and professional trading in wine exclusive of VAT and duty.