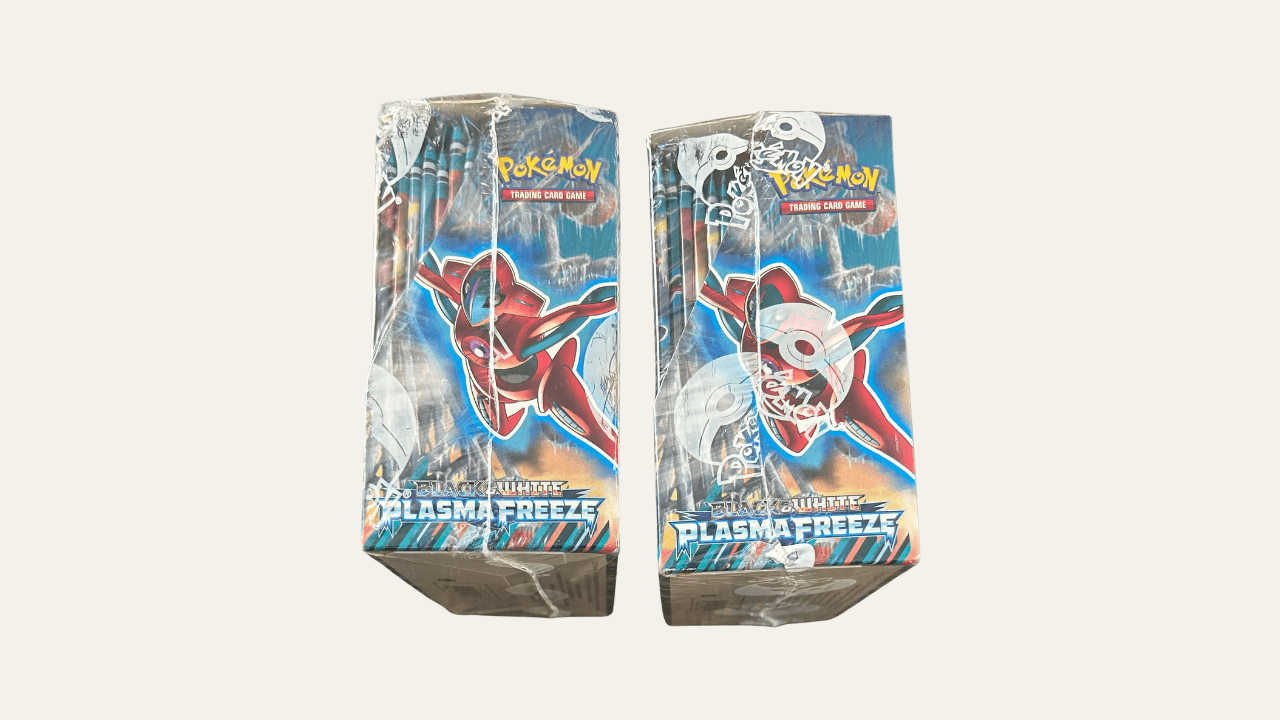

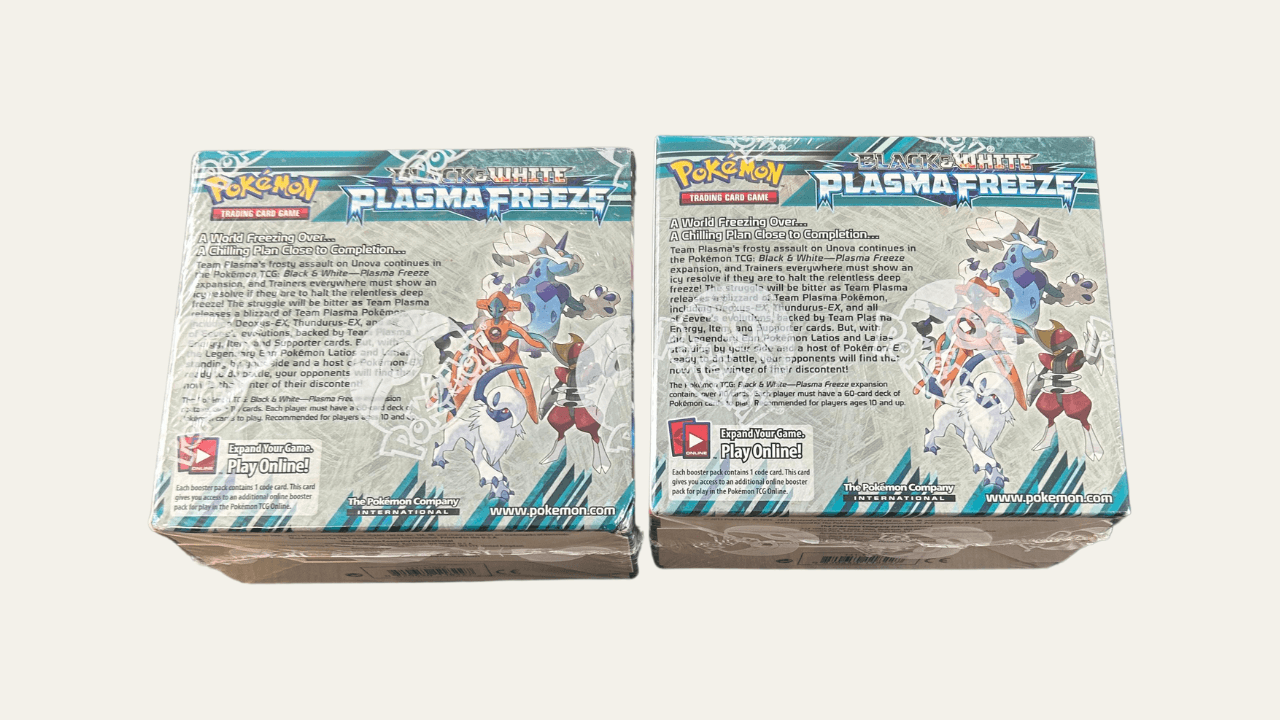

Pokémon, Black & White – Plasma Freeze, 2013 (two sealed booster boxes)

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €1,998 in 5 years.

Cost-to-return ratio⚖️: After deducting 2.4% in annual total costs, your net return could reach 26% per year.

Frozen in time: Plasma Freeze captures a moment in Pokémon history that collectors still cherish. The blue Team Plasma aesthetic, the EX-era artwork, and the low print run give this set a nostalgic energy that keeps demand strong. It is a time capsule of excitement, rarity, and childhood memories waiting to be rediscovered.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 4-6 Years |

| Expected CAGR (Balanced) | 26.0% p.a. after fees |

| Ambitious CAGR | 35.4% p.a. after fees |

| Entry Basis | ~3.2% entry discount |

| Sharpe Ratio | 0.67 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 84.8% chance to exceed €28,700 after 6 years |

| Standard Deviation | 38.9% |

| Risk Rating | C (6.8/10 - High Risk) |

- 4–6 year horizon: Matches BW sealed appreciation cycles and the supply contraction seen across late-BW sets.

- 26.0% CAGR (balanced): Based on applying 45% of the 64% CAGR achieved by Plasma Freeze over the last four years.

- 35.4% CAGR (optimistic): Supported by strong demand for Team Plasma sets and the limited remaining sealed supply.

- ~3.2% entry discount: Verified against the most recent October sale and confirmed by 14 historical trades.

- Sharpe ratio 0.67: Slightly above the five-year SMI benchmark of 0.61.

- 84.8% VaR threshold: High likelihood of exceeding €28,700 within six years.

- 38.9% standard deviation: Typical for sealed BW-era products.

- Risk rating “C”: Higher volatility but strong medium-term upside driven by scarcity and global collector activity.

Pokémon sealed boxes have a strong track record. Prices are transparent, sales are verifiable, and global demand is consistent. BW-era boxes benefit from low print runs, strong nostalgia, and limited surviving supply. As early 2010s sets graduate into the “modern vintage” category, investor attention continues to shift toward sealed BW products that show stable long-term appreciation and resilient liquidity.

Plasma Freeze is one of the most sought-after sets from the late BW era. It carries a clear collector identity, with iconic Team Plasma artwork and chase cards such as Deoxys EX and Heatran EX. Most boxes were opened years ago, leaving very few sealed units in circulation.

The entry price adds to the opportunity. The acquisition comes at a modest 3.2% discount versus the most recent sale and sits below the average listing range after fees. Historical data across 17 verified trades shows steady long-run appreciation driven by the set’s iconic status and BW-era scarcity.

Demand remains stable. The set trades actively on international marketplaces and at major auction houses. BW sealed products tend to perform well during nostalgia cycles and Pokémon anniversaries, which strengthen collector activity. As supply contracts further, surviving sealed stock becomes harder to source, giving these boxes a favourable position in the medium term.

The 4–6 year holding period reflects these demand cycles and provides enough time for sealed BW inventory to tighten further. Combined with a fair entry point and strong upside across both scenarios, these boxes offer a compelling long-term opportunity.

The two Plasma Freeze booster boxes combine scarcity, collector relevance, and strong long-term performance. Their low surviving supply, historical growth, and validated entry price support an attractive medium-term outlook. As BW sealed products continue to transition into a high-demand vintage category, these boxes are well positioned for steady appreciation over the 4–6 year horizon.

Expert

Collectorsdeal was born from a true passion for collecting and play. What started as a personal hobby quickly grew into a joyful project.