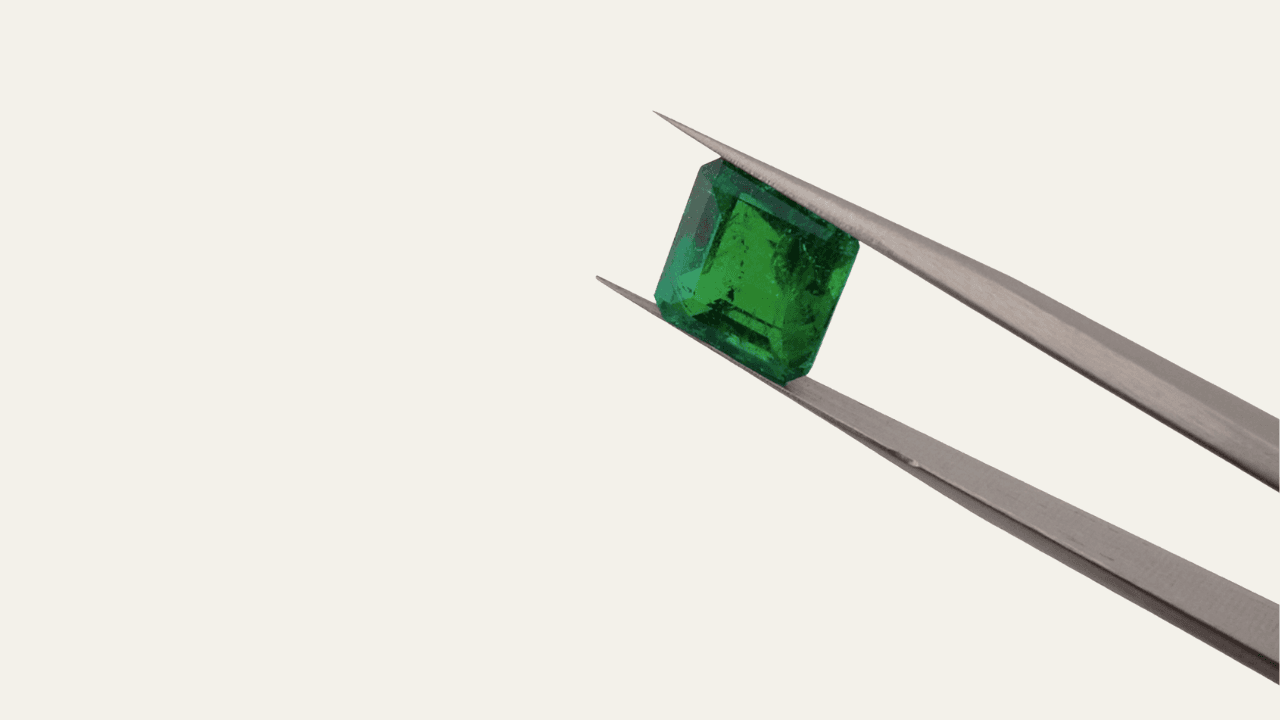

Emerald, untreated, 3.42 ct

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €1,236 in 5 years.

Cost-to-return ratio⚖️: After deducting 2.5% in annual total costs, your net return could reach 13.8% per year.

Timeless appeal: Top-quality Colombian emeralds have a timeless emotional appeal. Their colour, rarity and geological uniqueness create a sense of permanence that few assets can match. This rare and natural stone, anchored in centuries of tradition, gives investors a piece of beauty that endures across generations.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 5-7 Years |

| Expected CAGR (Balanced) | 13.8% p.a. after fees |

| Ambitious CAGR | 19.2% p.a. after fees |

| Entry Basis | ~29% entry discount |

| Sharpe Ratio | 0.80 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 96.3% chance to exceed €21,400 after 7 years |

| Standard Deviation | 17.3% |

| Risk Rating | A (8.8/10 - Low Risk) |

- 5-7 year horizon: Matches long-term appreciation patterns of untreated Colombian emeralds and aligns with tightening mine supply and rising global demand.

- 13.8% CAGR (balanced): Based on a 70% probability of achieving the historical 12.1% CAGR from 2010–2023, plus the uplift created by the 29% net entry discount.

- 19.2% CAGR (optimistic): Supported by strong demand for untreated stones above 3 carats and continued supply pressure across Colombian deposits.

- ~29% entry discount: The total acquisition price of €21,400 reflects a 39% gross discount and a 29% net discount versus B2C fair value of around 30,000 EUR.

- Sharpe Ratio 0.80: above the SMI benchmark of 0.61

- 96.3% VaR threshold: Indicates a high probability that the stone exceeds €21,400 after seven years, supporting strong downside protection.

- Standard deviation 17.3%: Reflects historically low volatility within the fine-gemstone segment and stable long-term price development.

- Risk rating “A”: High-quality, untreated emeralds combine rarity, stable long-term demand, and limited supply, offering a strong defensive profile.

Gemstones have been collected for centuries for their rarity, durability, and cultural value. High-quality natural stones tend to hold their value well and show steady long-term appreciation. Their market is driven by scarcity, craftsmanship, and global collector demand rather than short-term trends. Untreated stones with strong color and high clarity sit at the top of the category and show some of the most stable price patterns across the alternative asset space.

This 3.42 ct emerald is an exceptional example of Muzo-level color quality, with a vivid, saturated green and high transparency that place it among the rarest Colombian stones available today. Untreated emeralds above 3 carats are extremely limited, and supply from key Colombian deposits continues to decline. This scarcity supports long-term value growth and provides natural downside protection.

The entry price strengthens the case. The stone was acquired with a 39% discount before fees and a 29% discount after fees, verified against comparable untreated emeralds of similar weight and quality. This pricing advantage allows investors to enter at a clear value gap relative to retail benchmarks.

Demand for untreated emeralds continues to grow among collectors, private banks, and Asian buyers. Market data from 2010–2023 shows a 12.1% CAGR for comparable stones, with low historical volatility and consistent appreciation across market cycles. At a balanced projection of 13.81% per year and a strong 96.3% VaR profile, this asset combines rarity, stability, and a high-quality entry point within a trusted category.

This emerald represents a rare top-tier gemstone with strong cultural appeal, limited supply, and verified value potential. Its untreated nature, exceptional color, and size create a strong foundation for long-term appreciation, making it a compelling addition to a diversified alternative investment portfolio.

Expert

Carat Investments is a Swiss-based investment boutique specializing in real assets, with a primary focus on colored gemstones. Founded on a heritage of excellence and discretion, the company bridges centuries-old gemstone expertise with modern financial acumen to offer clients exclusive, inflation-resistant investment opportunities. Built on values of sustainability, integrity, and long-term vision, Carat Investments empowers clients to preserve and grow their wealth across generations.