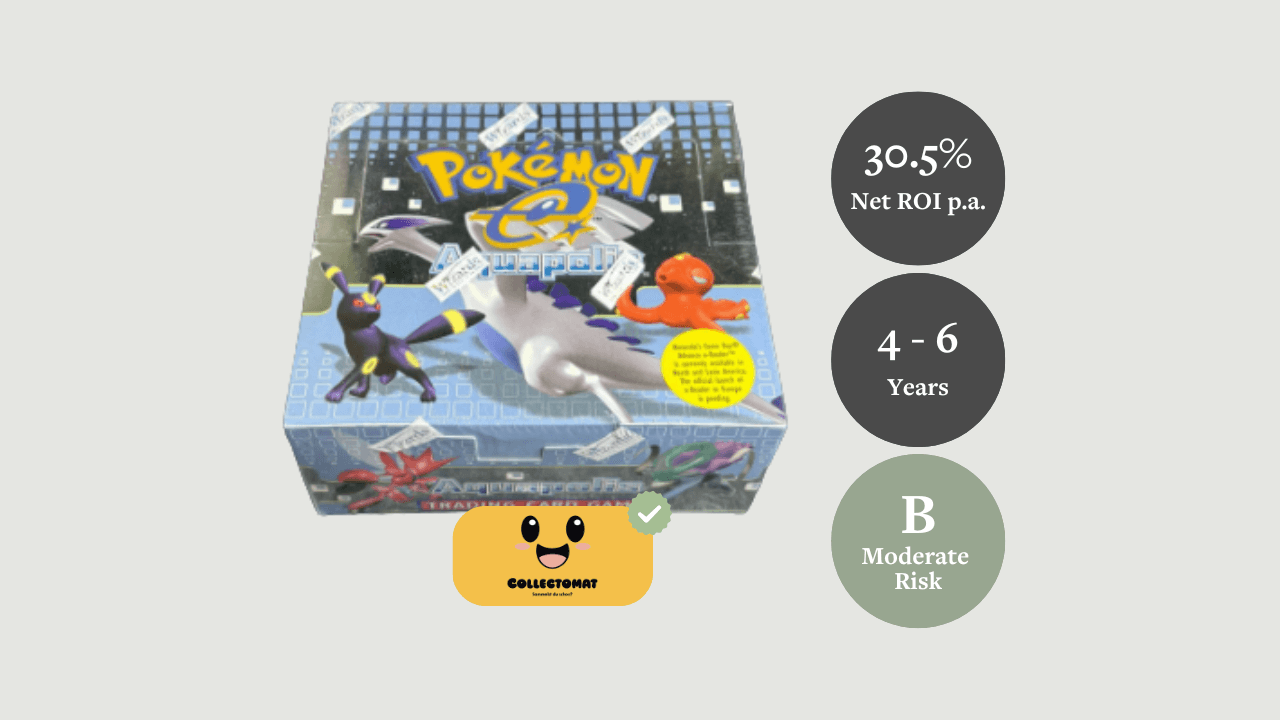

Pokémon Aquapolis Booster Box

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of €500 could reach an estimated value of €2,470 in 6 years.

Cost-to-Return Ratio⚖️: With just 1.8% annual total costs, your net profit could be 30.5% per year.

The Legacy of the e-Card Era ✨: Aquapolis captures a moment of pure creative experimentation in Pokémon history. It represents the franchise’s leap toward innovation—bridging physical cards with digital interaction through e-Reader technology. Collectors value it as a cultural artifact of the early 2000s: bold, rare, and now nearly extinct in sealed form. Owning such a display means safeguarding a vanished chapter of Pokémon’s evolution.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 4 to 6 Years |

| Expected CAGR (Balanced) | 30.5% p.a. |

| Optimistic CAGR | 41.2% p.a. |

| Entry Premium | 0.0% (fair value) |

| Sharpe Ratio | 0.77 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 91% chance to exceed initial investment after 6 years |

| Standard Deviation | 38.9% |

| Risk Rating | B (8.0/10 – Moderate Risk) |

- 4–6 Year Horizon: Targeted exit between 2029 and 2031, designed to align with collector hype cycles and long-term scarcity trends in sealed vintage boxes.

- 30.5% CAGR (Balanced): Derived from applying 15% of the observed 218% CAGR in Aquapolis pack sales between February and December 2025.

- 41.2% CAGR (Optimistic): Based on accelerated momentum and premium auction pricing of sealed assets in bull market scenarios.

- 0.0% Entry Premium: The offer price reflects fair market value based on verified October 2025 sales adjusted for Pokémon index growth (no discount or markup).

- Sharpe Ratio of 0.77: Demonstrates a strong risk-adjusted return profile outperforming traditional equity benchmarks like the SMI (0.61).

- 91% VaR Threshold: Indicates a 91% probability that the value will exceed the original investment after 6 years, reflecting strong downside protection.

- Standard Deviation of 38.9%: Risk modeled using four comparable sealed boxes, consistent with historical volatility across high-value TCG assets.

- Risk Rating “B (8.0/10)”: Robust risk-return profile supported by 46 verified sales (2025) and sustained collector demand for Aquapolis-era booster boxes.

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the value of the card and the prevailing market situation, we can either sell the card privately to a collector or take it to auction. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Investing in Pokémon cards is particularly timely with the franchise’s upcoming jubilee, expected to drive heightened interest and value appreciation in rare and nostalgic collectibles.

The Pokémon Aquapolis Booster Box stands out as a premier sealed collectible from the e-Card era, renowned for its innovation, aesthetic quality, and deep nostalgic appeal. Released in 2003 as the second e-Card expansion and the 15th Pokémon TCG set, Aquapolis introduced groundbreaking elements such as Crystal Pokémon—rare cards featuring multiple energy types—and the Dot-Code system, which allowed players to scan cards for mini-games and unique data interactions.

From a collector’s standpoint, Aquapolis embodies a transition between traditional TCG gameplay and early digital experimentation, making it a significant milestone in Pokémon’s evolution. The set’s expansive 186-card lineup, including holograms, secret rares, and alternate versions, was the largest of its time, amplifying its desirability. The sealed booster box, containing 36 original packs, provides one of the last opportunities to preserve or potentially unlock these historic cards in untouched condition.

The market for vintage Pokémon displays has remained consistently strong. Aquapolis boxes benefit from sustained demand driven by scarcity—most have been opened for grading or absorbed into long-term private collections. Between February and October 2025, 30 sales of comparable boxes confirmed active market liquidity and continued collector enthusiasm. The expert’s pricing validation—1.8x pack premium yet 6% below current eBay listings—reflects a fair market entry supported by real data.

With a modeled Value at Risk indicating an 89% probability of exceeding its original €90,200 purchase price after six years, the Aquapolis Booster Box combines rare historical significance with credible downside protection, situating it as one of the few vintage displays offering both nostalgia and measurable market strength.

The Pokémon Aquapolis Booster Box stands as both a rare historical collectible and a data-backed opportunity. With its strong track record, fair entry price, robust downside protection, and projected double-digit annualized return, it remains one of the few sealed displays combining scarcity, nostalgia, and verifiable market performance within a balanced risk framework.

Expert

Collectomat GmbH mainly sells trading cards in ultra-modern vending machines. In addition to classics such as Pokémon, the vending machines also offer boosters from One Piece, Disney, Sport, YuGiOh! and other formats.