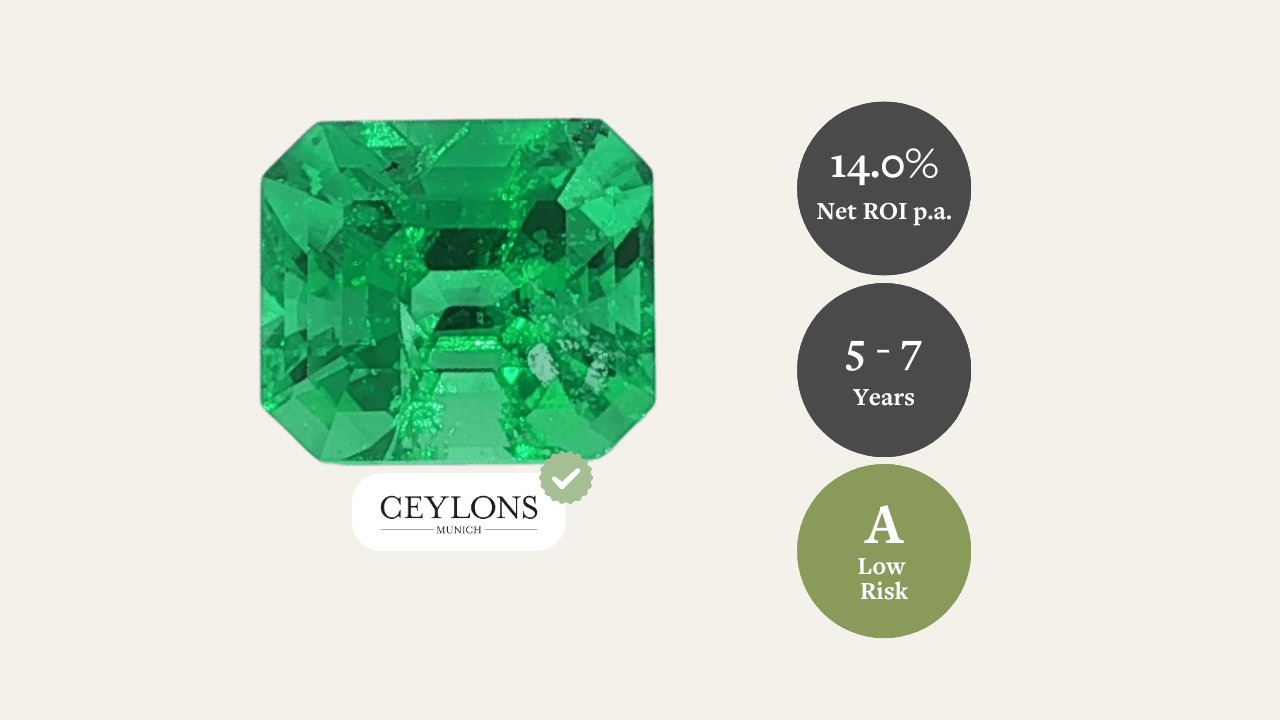

Emerald, 3.29 ct

Acheter l'actif entier

Demandez à acheter l'actif entier au lieu de simples fractions.

Principales raisons d'investir

Return potential: An investment of €500 could reach an estimated value of €1,254 in 5 years.

Cost-to-return ratio: After deducting 2.4% in annual total costs, your net return could reach 14.0% per year.

The Rarity of Ethiopian Origins 🟢: With its only mine depleted and virtually no new high-grade material in circulation, this emerald’s origin adds a powerful narrative edge. Most collectors know Colombia and Zambia—but Ethiopian provenance offers distinction and long-term upside due to its obscurity and geological rarity.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 5–7 Years |

| Expected CAGR (Balanced) | 14.0% p.a. after fees |

| Optimistic CAGR | 19.7% p.a. after fees |

| Entry Discount | ~34% after fees vs. comparable listed stones |

| Sharpe Ratio | 0.81 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 96.4% chance to exceed the release value after 7 years |

| Standard Deviation | 17.2% |

| Risk Rating | A (8.8/10 – Low Risk) |

- 5–7 year horizon: Aligned with historical holding periods of high-grade emeralds for appreciation and liquidity cycles.

- 14.0% CAGR (balanced): We assume a 70% probability of realizing the average annual return of 10.6% (CAGR 2010 - 2023) for the next 7 years and account for the discount at purchase date.

- 19.7% CAGR (optimistic): We assume a 85% probability of realizing the average annual return of 10.6% (CAGR 2010 - 2023) for the next 7 years and account for the discount at purchase date.

- ~34% entry discount: Acquired at €17,600 (~€5,300/ct) versus comparable stones above €31,000.

- Sharpe ratio 0.81: Higher risk-adjusted return potential than broad Swiss market index (SMI: 0.61).

- VaR 96.4%: Low probability of falling short of the release value after 7 years.

- 17.2% standard deviation: Moderate volatility supported by gemstone market stability.

- Risk rating A: Balanced risk profile with unique origin and certification advantages.

Gemstones have been collected for centuries for their rarity, durability, and cultural value. High-quality natural stones tend to hold their value well and show steady long-term appreciation. Their market is driven by scarcity, craftsmanship, and global collector demand rather than short-term trends. Untreated stones with strong color and high clarity sit at the top of the category and show some of the most stable price patterns across the alternative asset space.

This emerald represents a convergence of rarity, aesthetics, and provenance. It hails from a singular Ethiopian mine, now fully depleted since its 2016 discovery. Unlike more common Colombian or Zambian stones, Ethiopian emeralds of this quality are virtually unseen in the market. Its vibrant green color and VS-type clarity are especially notable, with only minor clarity enhancement—an industry-standard, acceptable practice in high-end emeralds.

At 3.29ct, the stone sits at an optimal size for collectors and investors. While pricing for top-tier Colombian stones with similar characteristics often exceeds €25,000+, this stone was acquired at €17,567—equivalent to just €5,300/ct—representing a strong entry discount relative to comparables from more recognized provenances. Given the lack of equivalent Ethiopian stones available publicly, this opens potential for provenance-based appreciation.

The Gübelin certificate adds confidence and credibility, supporting both resale and long-term value protection. Market trends in colored gemstones—particularly emeralds—have shown consistent strength in recent years, with collector attention shifting to rare origins and untreated or lightly treated stones.

The emerald is currently insured and will be stored under professional conditions, ensuring physical protection and full traceability for Splint Invest clients. Given its aesthetics, origin, and scarcity, the asset aligns with collectors' increasing appetite for unique, historically rooted gemstones with strong visual appeal.

This emerald combines strong aesthetics with a unique origin and solid market fundamentals. With a meaningful entry discount and rare provenance, it offers strong appreciation potential within a professionally structured holding.

Expert

At CEYLONS | MUNICH , we redefine the essence of rarity. Our exclusive access to rare gemstones is matched only by our dedication to quality. Our commitment to excellence is rooted in our “mine to market” approach, ensuring a traceable journey from the source to your hands. By embracing a direct supply chain, we eliminate middlemen, placing you at the forefront of a seamless and trustworthy gemstone experience. Discover the allure of gemstones like never before, where each stone tells a tale of its journey, and every purchase reflects our unwavering commitment to value and authenticity.