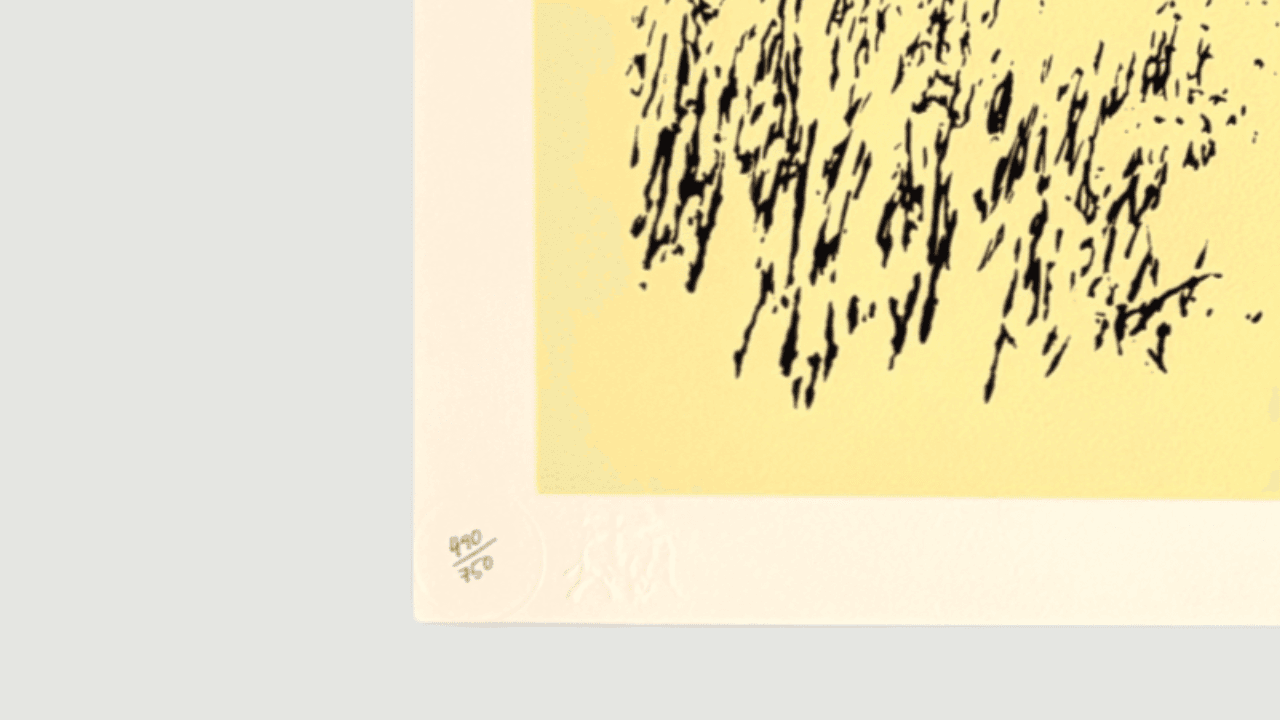

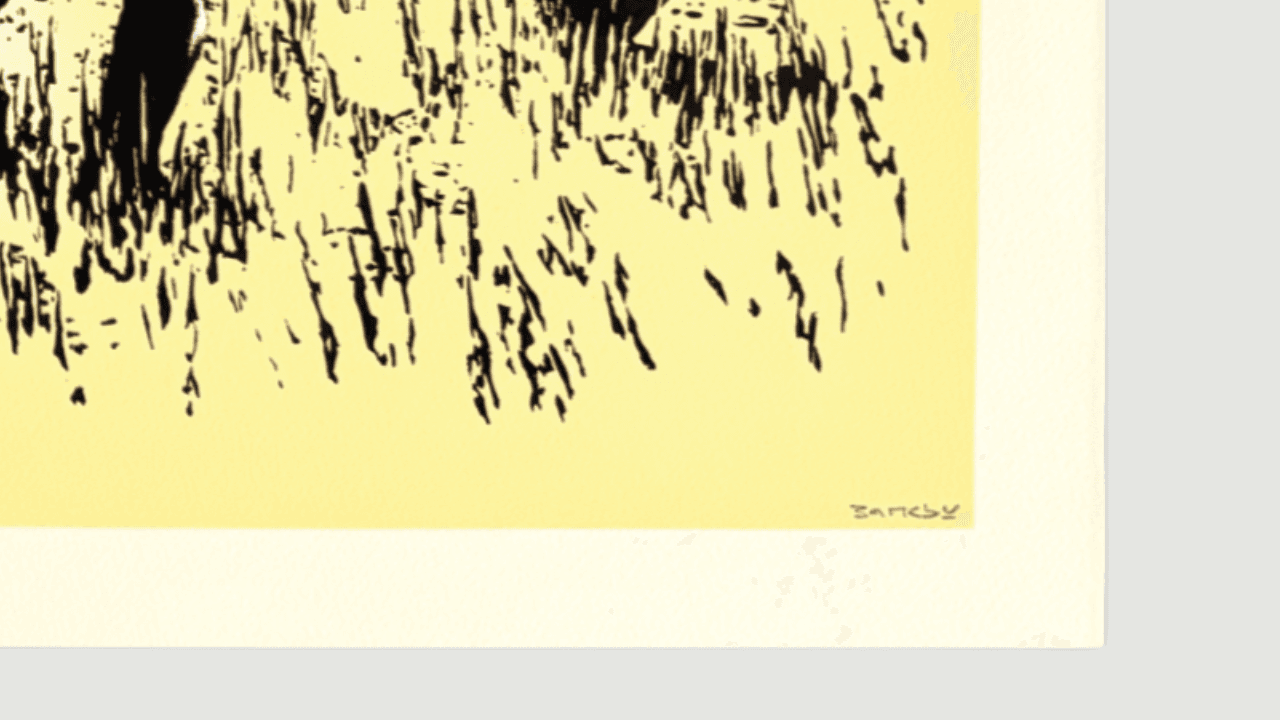

Banksy, Coloured Trolleys, 2007

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €1,035 in 4 years.

Cost-to-return ratio⚖️: With just 3.3% annual total costs, your net profit could be 19.9% per year.

The hunt for meaning 🎯 Coloured Trolleys captures the moment where humour and criticism meet: Banksy turns a simple shopping cart into a symbol of modern habits, and the three hunters give it a timeless, almost mythic quality. Many collectors value this print because it feels current even after two decades. It is playful, sharp, and instantly recognisable, which keeps it relevant and desirable.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 2–4 Years |

| Expected CAGR (Balanced) | 19.9% p.a. after fees |

| Ambitious CAGR | 22.9% p.a. after fees |

| Entry Basis | ≈19.6% vs best gallery benchmark |

| Sharpe Ratio | 0.66 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 90% chance to exceed €29,200 after 4 years |

| Standard Deviation | 31.9% |

| Risk Rating | B (7.6/10 - Moderate Risk) |

- 2-4 year horizon: Matches Banksy’s typical print appreciation cycle and aligns with stable medium-term demand.

- 19.9% CAGR (balanced): Based on equal weighting of three historic growth periods from 2010–2025.

- 22.9% CAGR (optimistic): Supported by strong past highs and sustained buyer interest.

- ≈19.6% entry discount: Verified against best gallery price and recent comps.

- Sharpe ratio 0.66: Slightly above the SMI benchmark of 0.61.

- 90% VaR threshold: High likelihood of exceeding €29,200 within four years.

- Standard deviation 31.9%: Typical for blue-chip print markets.

- Risk rating “B”: Solid medium-term opportunity within a mature and well-defined market.

For centuries, art was collected for its cultural, emotional, intellectual, political, and economic value. Investing in a mid-career artist offers a mix of financial potential and personal satisfaction, making it an appealing option for both new and seasoned collectors.

Coloured Trolleys sits at the centre of Banksy’s commentary on consumption and modern behaviour. Released in 2007 through Pictures on Walls, it reflects the period when Banksy’s print market began to expand globally. The scene is simple but direct: three cavemen tracking supermarket trolleys. Nearly twenty years later, the message remains clear, and the image still circulates in catalogues, exhibitions, and media coverage.

This print comes from the signed edition of 750. Signed Banksy editions sit at the top of his print market and have shown stable liquidity for more than a decade. Recent sales of signed Trolleys works continue to fall between £20,000 and £30,000, even through volatile market cycles. This stability helps give the piece a reliable base for appreciation.

The entry point strengthens the case. The total acquisition price of €29,200 reflects a 19.6% discount relative to the strongest gallery benchmark and still sits below recent public sales. The work also reached a high of £96,500 in 2020, showing how the market can react when demand accelerates.

Banksy’s broad visibility adds another layer. His name appears in mainstream media, museum discussions, and public debates on politics and culture. This constant attention drives ongoing demand from younger collectors who often enter the art market through prints. It also supports long-term liquidity across Europe, the US, and Asia.

From an investment perspective, the combination of a low entry price, strong cultural relevance, and a long record of sales supports a solid 2–4 year horizon. Banksy’s market delivers clear patterns: stable long-run growth, periodic spikes, and consistent buying interest. Coloured Trolleys fits neatly within this structure: recognisable, signed, and proven to perform. It offers an accessible way to enter the blue-chip segment of contemporary print collecting.

Banksy’s Coloured Trolleys offers a mix of strong cultural visibility, a favourable entry price, and a long record of stable sales. The signed edition, historical high of £96,500, and reliable demand create a clear case for medium-term appreciation, making it a compelling addition to a diversified alternative asset portfolio.

Expert

TGB London Limited, founded in 2016 by Simon Portlock and Bradley Ridge is an art advisory and brokerage company. Leveraging the expertise of Simon and Bradley in the contemporary art market, TGB specialises in guiding collectors to curate world-class art collections. With a commitment to excellence, TGB provides unparalleled insights and support to art collectors ensuring the creation of exceptional and noteworthy collections.