Daniel Buren, Monochrome, Encadre De Rayures Blanches, 2005

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of €500 could reach an estimated value of €1,150 in 4 years.

Cost-to-Return Ratio⚖️: After deducting 2.7% in annual total costs, your net return could reach 23.2% per year.

Institutional Endorsement Drives Value 🎖: Daniel Buren’s accolades—including the Golden Lion at the Venice Biennale and exhibitions at Documenta—cement his critical stature. His works are held by institutions like Centre Pompidou, MoMA, and Tate Modern, reinforcing market demand. This level of institutional validation ensures enduring relevance, cross-cycle stability, and sustained visibility in the art world—factors that support long-term value appreciation and collector confidence.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 2–4 Years |

| Expected CAGR (Balanced) | 23.2% p.a. after fees |

| CAGR (Optimistic) | 27.9% p.a. after fees |

| Entry Discount | ~22.8% below size-adjusted fair value |

| Sharpe Ratio | 0.76 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 93% chance to exceed €107,750 after 4 years |

| Standard Deviation | 31.0% |

| Risk Rating | B (8.0/10 - Moderate Risk) |

- 2–4 Year Horizon: Aligned with Buren’s ongoing institutional visibility and stable secondary market depth.

- 23.2% CAGR (Balanced): Based on an 80% probability of repeating the 23.0% CAGR observed across comparable auction periods, while factoring in the current 22.8% discount to market estimates.

- 27.3% CAGR (Optimistic): Based on an 100% probability of repeating the 23.0% CAGR observed across comparable auction periods, while factoring in the current 22.8% discount to market estimates.

- ~22.8% Entry Discount: Acquisition priced below size-normalized fair value (2018–2023 median benchmark).

- Sharpe Ratio of 0.76: Demonstrates strong risk-adjusted efficiency relative to the SMI’s five-year Sharpe (0.61).

- 93% VaR Threshold: Model indicates a 93% probability of exceeding €107,750 after four years, supporting robust downside protection.

- Standard Deviation (31.0%): In line with established blue-chip contemporary comparables, reinforcing controlled exposure.

- Risk Rating "B": Balanced risk profile supported by market maturity, institutional validation, and 40 recent auction reference points.

For centuries, art was collected for its cultural, emotional, intellectual, political, and economic value. Investing in a mid-career artist offers a mix of financial potential and personal satisfaction, making it an appealing option for both new and seasoned collectors.

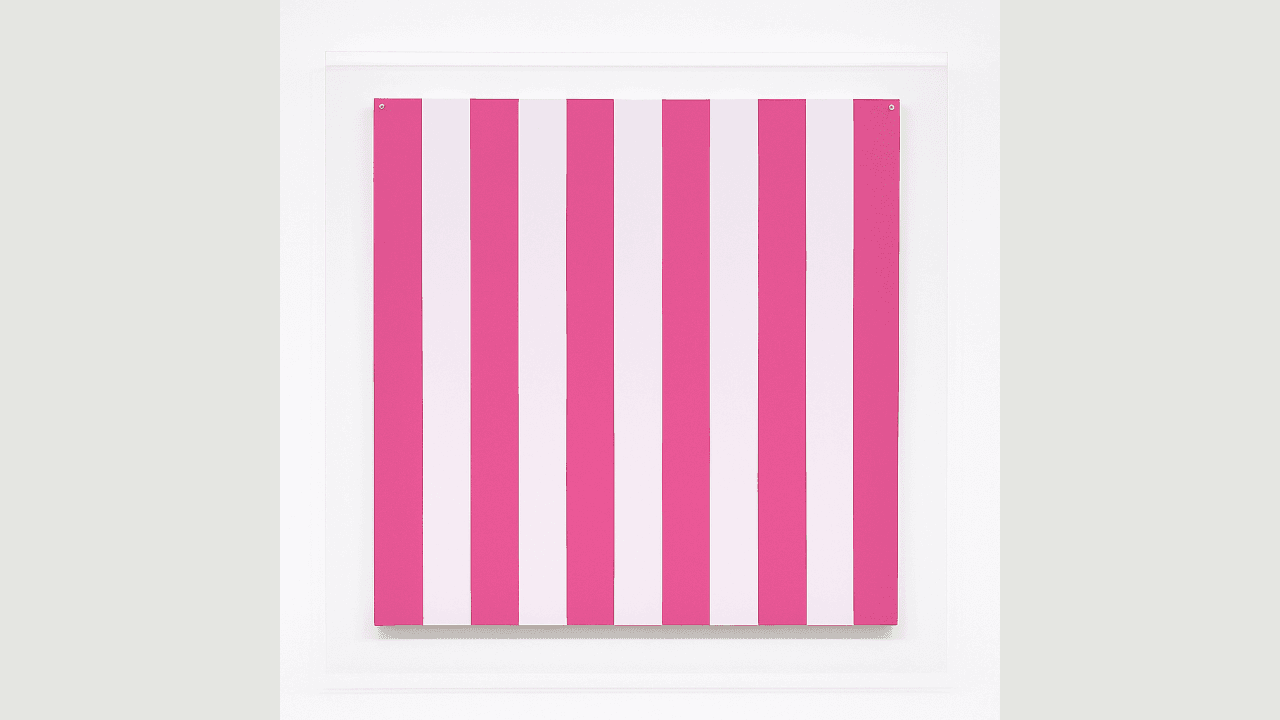

Daniel Buren is one of the central figures of post-war Conceptual Art, known for transforming the role of painting by foregrounding the conditions of display, the architecture of space, and the viewer’s physical experience. Since the 1960s, his consistent use of 8.7 cm vertical stripes has served as both a visual signature and a conceptual tool—a way to examine how artworks operate within social and physical contexts. This unique visual language has made his works instantly recognizable and highly sought after by both private collectors and institutions.

MONOCHROME, ENCADRÉ DE RAYURES BLANCHES (2005) is part of a period in which Buren expanded his exploration of perception through constructed framing, reflecting a dialogue between color, structure, and spatial awareness. The monochrome field, set within his signature striped border, creates a precise, focused composition that prompts the viewer to become aware not only of the artwork itself, but of the environment surrounding it. The inclusion of plexiglass introduces subtle shifts in light and depth, reinforcing the sensory and architectural qualities central to Buren’s work.

Institutional validation for Buren is extensive and longstanding: his work is held in the permanent collections of the Centre Pompidou, MoMA, Tate Modern, and numerous other major museums globally. He has been a recurring participant in international exhibitions including the Venice Biennale (where he was awarded the Golden Lion in 1986) and Documenta. His secondary market is considered mature and stable, with consistent demand for works that clearly articulate his core visual identity. Because many of these pieces are already held in museum or long-term private collections, availability of comparable works remains limited. This combination of aesthetic clarity, conceptual rigor, institutional recognition, and scarcity supports a compelling long-term value narrative.

This work combines unique status, strong institutional lineage, market maturity, and clear visual identity. The attractive entry pricing and documented historical price appreciation provide meaningful upside potential, while the artist’s long-standing international recognition supports lasting demand. It stands as a disciplined, strategically positioned blue-chip acquisition.

Expert

Founded in Singapore in 1994, Opera Gallery has forged, over its 30 years, a network of 16 galleries worldwide including London, Paris, New York, Geneva, Hong Kong, and Seoul, establishing itself as one of the leading global players within the international art market. Headed by Gilles Dyan, Opera Gallery specialises in post-war French art, and in Modern and Contemporary European, American, and Asian art. In addition, the gallery represents international emerging artists such as Andy Denzler, Anthony James and Gustavo Nazareno. and more established contemporary artists such as Ron Arad, Manolo Valdés, and Anselm Reyle.