Sold out

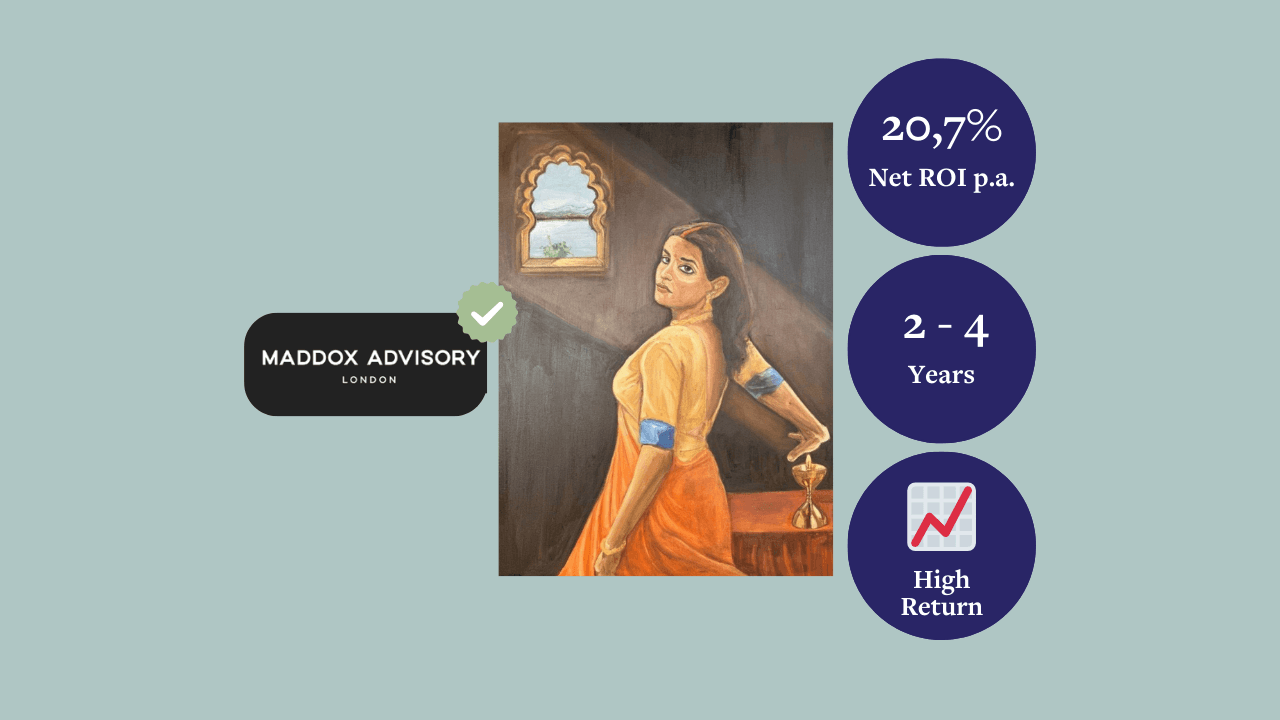

Raghav Babbar, Pratigya, 2024

Asset value

128.716,00 €

Earning potential

20.72%

Splints left

0/1.937

Investment horizon in years

2-4

Return-to-Risk Assessment

7/10

Performance since release

+32.9%

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of 500 EUR is projected to be worth approximately 1,062 EUR in 4 years.

Cost-to-Return Ratio⚖️: After deducting 2.7% in annual total costs (including exit fees), your net return could reach 20.7% per year.

Auction Prices 🔨: Over the last 28 months, Babbar's works have been selling for +1,139% above their high estimate. In addition, he has seen 100% of his work sold at auction reach prices over the high estimate.

Description

Valuation Summary 📝

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent gallery transactions and current auction results. Our analysis confirmed that the price offered, inclusive of all associated fees, is still highly competitive. To estimate the potential ROI, we used the average auction results of same-sized paintings by Raghav Babbar and compared them to the purchase price. For our conservative scenario, we assumed the value of the painting would grow at the rate of Swiss inflation, reflecting a defensive approach. In the balanced scenario, we calculated the average growth of the painting taking into account the average auction results, and then discounted it to 40% to account for the risk of not replicating past auction results. Finally, in the ambitious scenario, we applied 100% of the average auction results for same-sized paintings over the last two years compared to our purchase price, reflecting an optimistic outlook that assumes the painting will continue to appreciate in line with its historical trend.

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the prevailing market situation, the painting will be sold to a private collector or offered as a single lot at an auction for contemporary art. An auction is considered if the price has developed to the point where the minimum bid matches the market value and there is high demand for works by the artist. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Why Invest in This Category? 🎨

For centuries, art has been collected for its cultural, emotional, intellectual, political, and economic value. Investing in emerging artists offers a mix of financial potential and personal satisfaction, making it an appealing option for both new and seasoned collectors.

Why Invest in This Asset? 💎

Raghav Babbar, born in Rohtak near Delhi, blends his Indian heritage with mid-20th-century British art techniques in his figurative paintings. He is known for his lavish use of oil paint, creating richly textured portraits that emphasize the physical presence and emotions of his sitters, often ordinary working people depicted in natural light with dramatic shadows.

As a young, evolving artist, Raghav has started exploring larger compositions and incorporating faster techniques like ground chalk. lnfluenced by his travels in Uttarakhand and Sikkim, he studied at Lasalle College of Art in Singapore and now lives in London, pursuing an MFA at the Royal College of Art.

A compelling rationale for considering Raghav Babbar's art for investment lies in his consistent track record of surpassing auction expectations. On average, his artworks fetch prices that are 11 times higher than their initial estimates, presenting a potentially lucrative investment avenue. For instance, "The Coal Seller," initially estimated at EUR 22,543, fetched an impressive EUR 541,033 at Sotheby's auction. In addition, Raghav Babbar has seen 100% of his work sold at auction reach prices over the high estimate and the total sales turnover at auctions totaled GBP 2,419,222 since 2022.

Context in Time ⏳

Emerging artists often sell their works at more affordable prices compared to established names. If the artist gains recognition over time, the value of their art can increase significantly, offering substantial returns on your investment.

Conclusion 🎯

Investing in Raghav Babbar's art is not just about cultural appreciation—it's about making a strategic financial decision. With his consistent auction performance, this asset offers a blend of passion and profit, with potential returns that could match or exceed expectations.

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent gallery transactions and current auction results. Our analysis confirmed that the price offered, inclusive of all associated fees, is still highly competitive. To estimate the potential ROI, we used the average auction results of same-sized paintings by Raghav Babbar and compared them to the purchase price. For our conservative scenario, we assumed the value of the painting would grow at the rate of Swiss inflation, reflecting a defensive approach. In the balanced scenario, we calculated the average growth of the painting taking into account the average auction results, and then discounted it to 40% to account for the risk of not replicating past auction results. Finally, in the ambitious scenario, we applied 100% of the average auction results for same-sized paintings over the last two years compared to our purchase price, reflecting an optimistic outlook that assumes the painting will continue to appreciate in line with its historical trend.

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the prevailing market situation, the painting will be sold to a private collector or offered as a single lot at an auction for contemporary art. An auction is considered if the price has developed to the point where the minimum bid matches the market value and there is high demand for works by the artist. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Why Invest in This Category? 🎨

For centuries, art has been collected for its cultural, emotional, intellectual, political, and economic value. Investing in emerging artists offers a mix of financial potential and personal satisfaction, making it an appealing option for both new and seasoned collectors.

Why Invest in This Asset? 💎

Raghav Babbar, born in Rohtak near Delhi, blends his Indian heritage with mid-20th-century British art techniques in his figurative paintings. He is known for his lavish use of oil paint, creating richly textured portraits that emphasize the physical presence and emotions of his sitters, often ordinary working people depicted in natural light with dramatic shadows.

As a young, evolving artist, Raghav has started exploring larger compositions and incorporating faster techniques like ground chalk. lnfluenced by his travels in Uttarakhand and Sikkim, he studied at Lasalle College of Art in Singapore and now lives in London, pursuing an MFA at the Royal College of Art.

A compelling rationale for considering Raghav Babbar's art for investment lies in his consistent track record of surpassing auction expectations. On average, his artworks fetch prices that are 11 times higher than their initial estimates, presenting a potentially lucrative investment avenue. For instance, "The Coal Seller," initially estimated at EUR 22,543, fetched an impressive EUR 541,033 at Sotheby's auction. In addition, Raghav Babbar has seen 100% of his work sold at auction reach prices over the high estimate and the total sales turnover at auctions totaled GBP 2,419,222 since 2022.

Context in Time ⏳

Emerging artists often sell their works at more affordable prices compared to established names. If the artist gains recognition over time, the value of their art can increase significantly, offering substantial returns on your investment.

Conclusion 🎯

Investing in Raghav Babbar's art is not just about cultural appreciation—it's about making a strategic financial decision. With his consistent auction performance, this asset offers a blend of passion and profit, with potential returns that could match or exceed expectations.

Expert

Maddox Advisory

The art investment advisors of Maddox bring together years of specialist knowledge and practical experience with objective market analysis to offer their clients quality advice and consistent returns.

Additional details

Asset ID

2dd0dcc8-6efb-4802-ba32-8cf7eb5b5686

Name

Pratigya

Artist

Raghav Babbar

Publication year

2024

Size

101.6 x 76.2 cm

Number of editions

Unique

Signature

Yes, on the back

Material

Oil on Canvas