Sold out

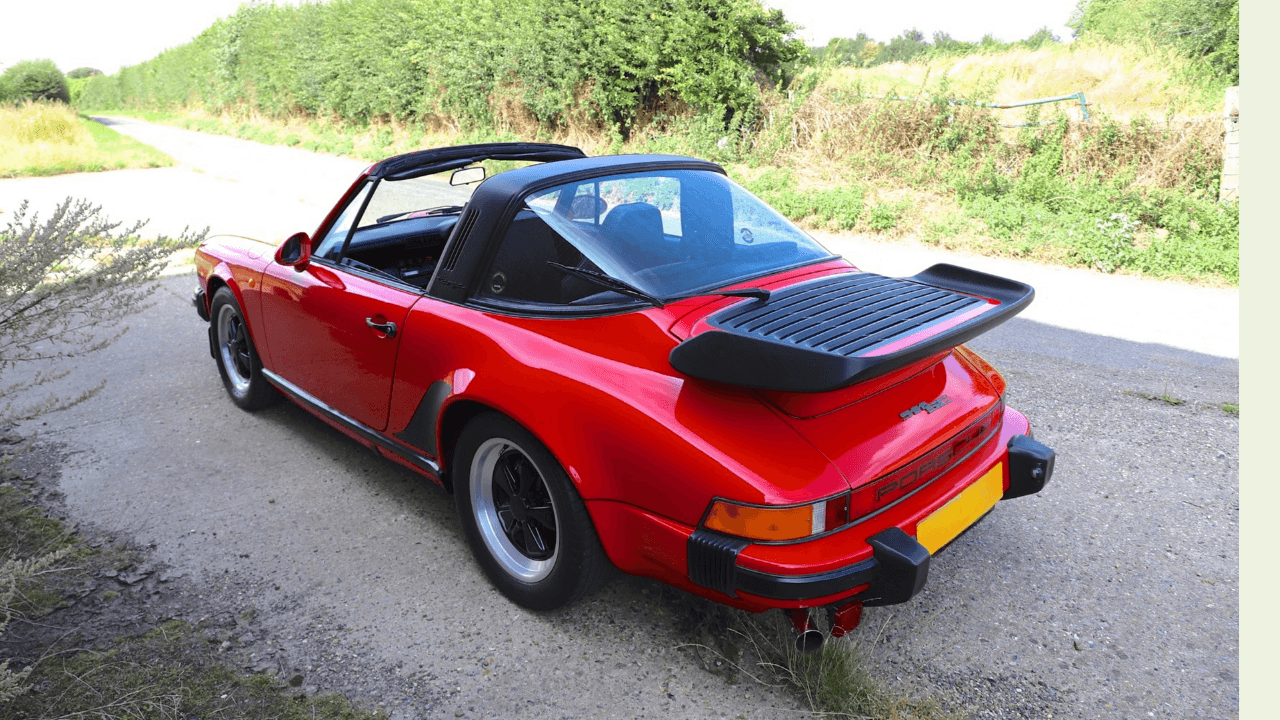

1988 Porsche 911 (930) 3.2 SC Targa in Guards Red

Asset value

99.811 €

Issue price per Splint

50 €

Total number of Splints

1.914

Investment horizon in years

2 to 4

Return-to-Risk Assessment

8/10

Since launch September ‘24

+4.3%

Main reasons to invest

Return Potential📈: An investment of 500 EUR is projected to be worth approximately 814 EUR in 4 years.

Cost-to-Return Ratio⚖️: After deducting 3.5% in annual total costs (including exit fees), your net return could reach 13.0% per year.

Collector’s Gem 💎: This Porsche 911 3.2 SC is a rare and iconic model, cherished for its classic design, low mileage, and air-cooled engine. Its uniqueness and desirability among collectors make it a valuable addition to any investment portfolio.

🔗Watch the video about this iconic model.

Description

Valuation Summary 📝

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent transactions and current market values across the UK, EU, and US. Our analysis confirmed that the price offered, inclusive of all associated fees, is still highly competitive. To estimate the potential ROI, we used the historical performance data of this specific Porsche 911 3.2 SC model as well as similar models. For our conservative scenario, we assumed the value of the car would grow at the rate of Swiss inflation, reflecting a defensive approach. In the balanced scenario, we calculated the average growth rate of the model and similar vehicles, then discounted it by 25% to account for the risk of not replicating past performance. Finally, in the ambitious scenario, we applied 100% of the historical average growth rate, reflecting an optimistic outlook that assumes the car will continue to appreciate in line with its historical trend.

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the car's value and the prevailing market situation, we can either sell the Porsche 911 3.2 SC privately to a collector or take it to auction. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Why Invest in This Category? 🚗

Classic cars remain one of the top-performing luxury asset classes, with a strong track record of appreciation. The demand for iconic models like the Porsche 911 continues to grow, driven by limited supply and increasing global interest. Investing in classic cars provides a unique hedge against inflation while diversifying your portfolio.

Why Invest in This Asset? 💎

The Porsche 911 3.2 SC is celebrated among collectors for its iconic design, engineering excellence, and the legacy it represents. This specific model, with its low mileage and pristine condition, is particularly desirable. As the car approaches its 40th anniversary, its value is expected to rise, making it a lucrative investment.

Context in Time ⏳

The classic car market is currently experiencing a renaissance, with significant appreciation across key models like the Porsche 911. As these vehicles become rarer, particularly well-maintained examples, the potential for substantial returns increases. This Porsche 911 3.2 SC is perfectly positioned to benefit from this trend, especially as it reaches its milestone anniversary.

Conclusion 🎯

Investing in the Porsche 911 3.2 SC is not just about owning a piece of automotive history—it's about making a strategic financial decision. With projected returns that could reach up to 18.1% annually, this asset offers a blend of passion and profit that is hard to match.

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent transactions and current market values across the UK, EU, and US. Our analysis confirmed that the price offered, inclusive of all associated fees, is still highly competitive. To estimate the potential ROI, we used the historical performance data of this specific Porsche 911 3.2 SC model as well as similar models. For our conservative scenario, we assumed the value of the car would grow at the rate of Swiss inflation, reflecting a defensive approach. In the balanced scenario, we calculated the average growth rate of the model and similar vehicles, then discounted it by 25% to account for the risk of not replicating past performance. Finally, in the ambitious scenario, we applied 100% of the historical average growth rate, reflecting an optimistic outlook that assumes the car will continue to appreciate in line with its historical trend.

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the car's value and the prevailing market situation, we can either sell the Porsche 911 3.2 SC privately to a collector or take it to auction. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Why Invest in This Category? 🚗

Classic cars remain one of the top-performing luxury asset classes, with a strong track record of appreciation. The demand for iconic models like the Porsche 911 continues to grow, driven by limited supply and increasing global interest. Investing in classic cars provides a unique hedge against inflation while diversifying your portfolio.

Why Invest in This Asset? 💎

The Porsche 911 3.2 SC is celebrated among collectors for its iconic design, engineering excellence, and the legacy it represents. This specific model, with its low mileage and pristine condition, is particularly desirable. As the car approaches its 40th anniversary, its value is expected to rise, making it a lucrative investment.

Context in Time ⏳

The classic car market is currently experiencing a renaissance, with significant appreciation across key models like the Porsche 911. As these vehicles become rarer, particularly well-maintained examples, the potential for substantial returns increases. This Porsche 911 3.2 SC is perfectly positioned to benefit from this trend, especially as it reaches its milestone anniversary.

Conclusion 🎯

Investing in the Porsche 911 3.2 SC is not just about owning a piece of automotive history—it's about making a strategic financial decision. With projected returns that could reach up to 18.1% annually, this asset offers a blend of passion and profit that is hard to match.

Expert

TheCarCrowd

The mission at TheCarCrowd is to give investors across the globe the opportunity to invest in one of the World’s fastest appreciating asset classes.

Additional details

Asset ID

32bff738-cf09-457a-95af-1ae86afef6a8

Brand

Porsche

Model

911 (930) SC Targa

Registration date

1988

Motor

3.2-liter flat-six engine

Kilometer

64,000 km

Power

231 bhp

Transmission

G50

Condition

1 excellent