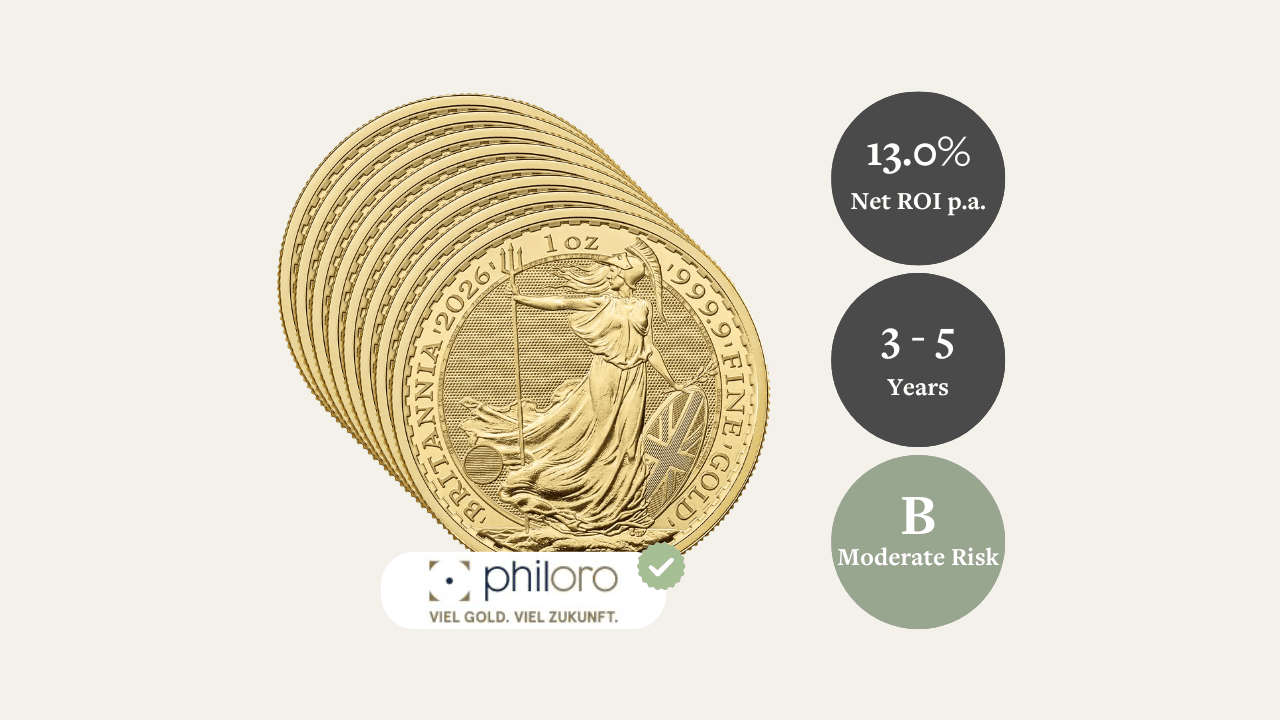

Britannia, 1 Unze (8 Gold Coins)

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of €500 could reach an estimated value of €922 in 5 years.

Cost-to-Return Ratio⚖️: With just 2.8% annual total costs, your net profit could be 13.0% per year.

A Reliable Store of Value ⚖️: Investing in Britannia gold coins represents stability and value preservation within a portfolio. As a 24-carat bullion coin backed by government guarantee, it offers a physical shield against inflation, market uncertainty, and currency risks. Its global tradability provides both trust and flexibility.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 3–5 Years |

| Expected CAGR (Balanced) | 13.0% p.a. after fees |

| Optimistic CAGR | 13.9% p.a. after fees |

| Entry Discount | ~0% below spot price |

| Sharpe Ratio | 0.74 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 94.8% chance to exceed €34,581 after 5 years |

| Standard Deviation | 17.7% |

| Risk Rating | B (8.2/10 – Moderate Risk) |

-

3–5 Year Horizon: Structured to benefit from gold’s historical role as a hedge in times of inflation and market volatility.

-

13.0% CAGR (Balanced): Based on gold’s performance from 2015–2025, supported by global demand for store-of-value assets.

-

13.9% CAGR (Optimistic): Reflects potential momentum from rising geopolitical risk and long-term inflation concerns.

-

~0% Discount to Spot: Entry pricing aligns slightly below live gold spot levels as of October 2025.

-

Sharpe Ratio of 0.74: Solid return relative to volatility, offering better stability than many equity-based alternatives.

-

94.8% VaR Threshold: Model indicates a 3-in-4 chance of exceeding €34,581 after 5 years, ensuring measurable downside protection.

-

Standard Deviation (17.7%): Moderate historical volatility for the Britannia, consistent with its role as a crisis-hedging asset.

-

Risk Rating “B”: A resilient and time-tested asset class — ideal for diversifying portfolios with tangible wealth protection.

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the value of the coins and the prevailing market situation, we can either sell the coins privately to a collector or sell it through a specialist house. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Investing in coins offers a unique blend of security, liquidity, and historical significance. Unlike other assets, coins combine intrinsic value with collectible appeal, making them both a financial safeguard and a tangible piece of history. They provide an excellent hedge against inflation, are easy to store and transport, and enjoy global recognition. With a long-standing track record of wealth preservation, coin investments are an ideal choice for those seeking stability and long-term growth.

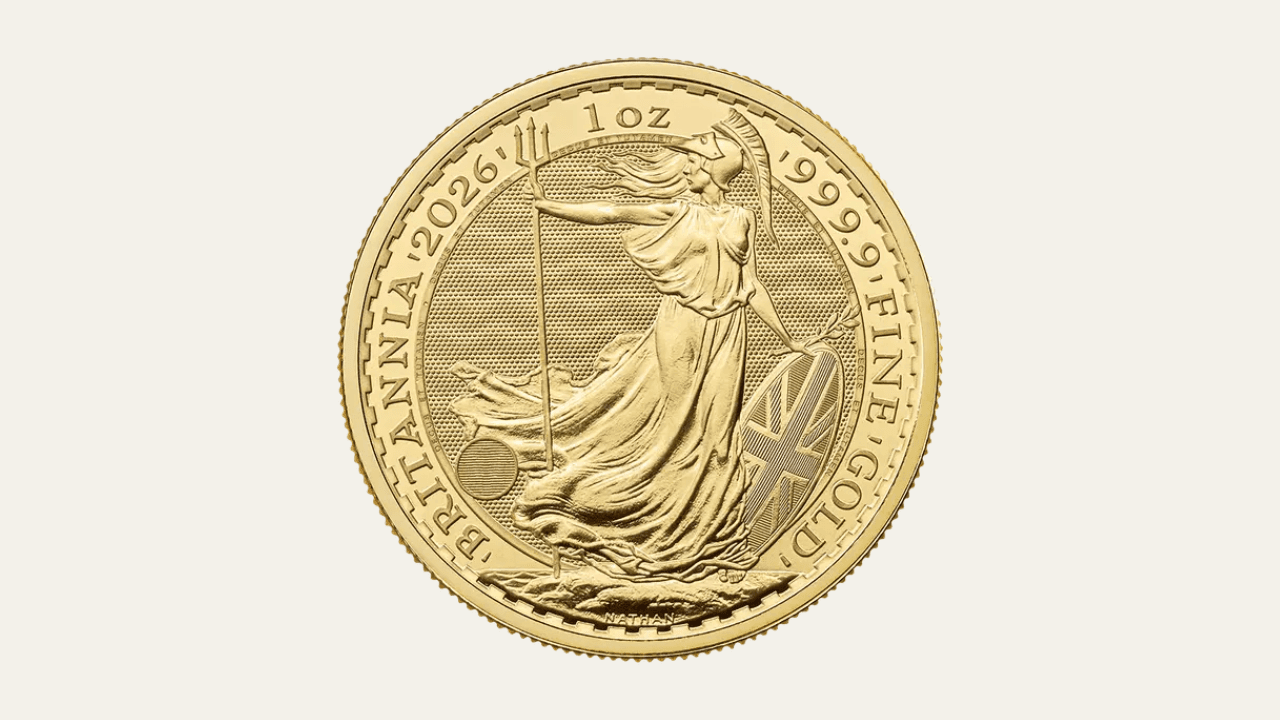

The Britannia is one of Europe's leading investment coins and has been minted by the Royal Mint in the United Kingdom since 1987. It is made of pure 24-carat fine gold (999.9/1000) and has established itself internationally thanks to its combination of quality, government guarantee and security features.

A key advantage of the Britannia is its tax appeal for British investors: it is not only VAT-free, but also exempt from capital gains tax as it is considered legal tender. These characteristics make it particularly attractive to long-term investors residing in the United Kingdom.

The Britannia is globally tradable and recognised by precious metal dealers worldwide, underscoring its high liquidity. Thanks to modern security features – including micro-engravings, surface animations and latent images – it is also one of the most counterfeit-proof gold coins on the market.

Its purity (999.9/1000) and traditional design featuring the figure of Britannia make it popular with both investors and collectors. It offers a solid way to hedge against inflation, currency devaluation and geopolitical risks – physically, tangibly and independently of digital systems.

The Britannia gold coin offers tax advantages, high purity, international tradability and modern security features. Combined with an attractive risk-return profile, it offers investors a robust, liquid and proven hedging strategy for times of economic uncertainty and long-term asset protection.

Expert

philoro is a reliable partner for investing in gold and silver. The company's highest quality standards for its products and comprehensive service have made it one of the market leaders in the precious metals trading sector in Europe.