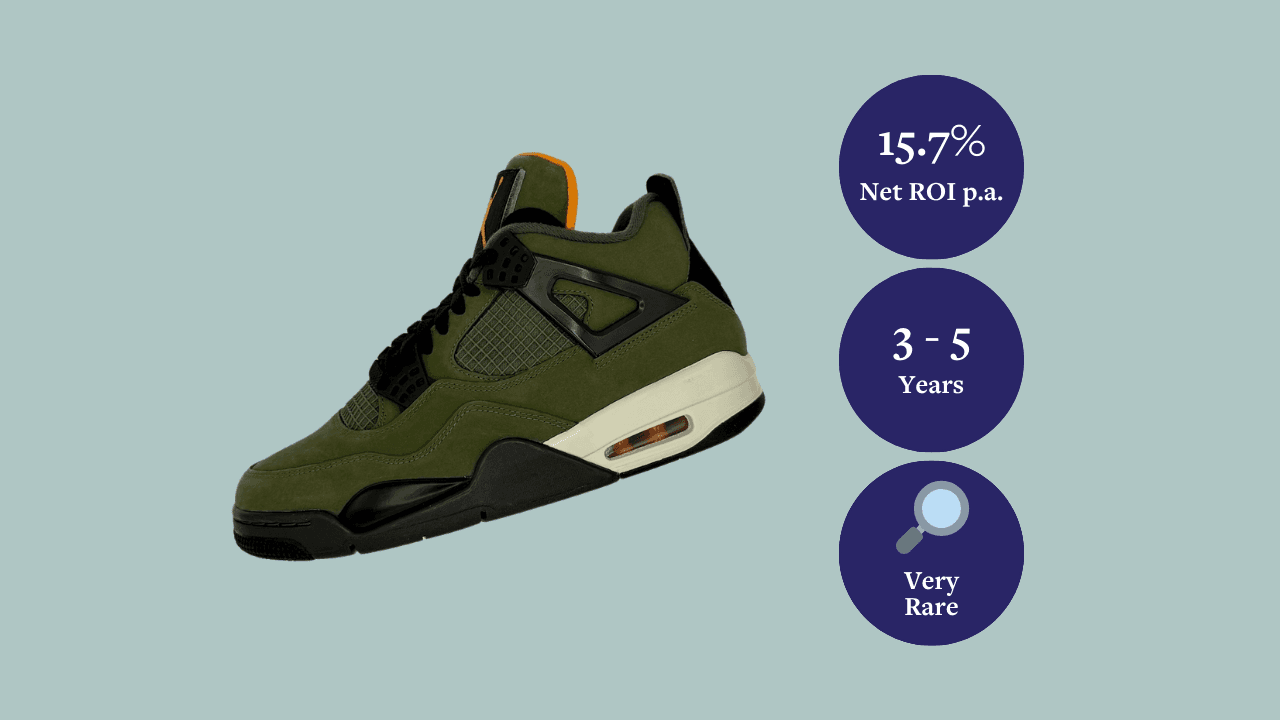

Nike Air Jordan 4 Undefeated Sample 2017

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of 500 EUR is projected to be worth approximately 1,034 EUR in 5 years.

Cost-to-Return Ratio⚖️: After deducting 3.0% in annual total costs (including exit fees), your net return could reach 15.7% per year.

Sneaker History 👟📈: A sample in the sneaker world is an exclusive prototype created in limited quantities before mass production. This rare sample, with unique details, is perfect for collectors looking to invest in historically significant and rare sneakers.

Description

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent transactions and current market values on the secondary sneaker market. Our analysis confirmed that the price offered, inclusive of all associated fees, is highly competitive. We used the historical performance data of this model. For our conservative scenario, we assumed the value of the sneaker would grow at the rate of Swiss inflation, reflecting a defensive approach. For the balanced scenario, we calculated the average annual value increase of this model over the past five years and factored in the price discount. In the ambitious scenario, we calculated 70% of the average annual growth rate of this model since its release in 2017 (7 years).

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the value of the model and the prevailing market situation, we can either sell the sneakers privately to a collector or take it to auction. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Why Invest in This Category? 👟

Sneakers have evolved from sportswear into high-value, collectible assets, gaining popularity as blue-chip investments. Their appeal is driven by cultural shifts, celebrity endorsements, and smart marketing. Today, sneakers sit at the intersection of fashion, art, and collectibles, fueling a booming secondary market. The global sneaker market is projected to reach USD 138,130 million by 2028, with a 7.2% annual growth rate. Historically, sneakers have shown impressive returns, with examples like the Jordan 1 Retro High Off-White Chicago delivering a 116% annualized performance over five years. This strong market growth and cultural relevance make sneakers a compelling investment opportunity.

Why Invest in This Asset? 💎

The Nike Air Jordan 4 Undefeated 2017 sample represents an ultra-rare investment opportunity. With recent auction prices reaching $28,000 for the 2017 model and $44,000 for the 2005 version, this sneaker offers immediate potential for capital appreciation. Its unique military-inspired design, exclusive Undefeated branding, and limited availability make it highly desirable among collectors and investors alike. Offered at a price significantly below recent auction results, it presents an exceptional chance to secure a valuable piece of sneaker history at an attractive price point.

Context in Time ⏳

The Nike Air Jordan 4, designed by Tinker Hatfield, debuted in 1989 and has since become a cultural icon, continually reinvented through collaborations and releases. Undefeated’s 2005 partnership with Jordan Brand marked a historic moment, and the 2017 sample reinterprets this classic with a fresh twist. With soaring demand for rare sneakers and record auction sales in 2022, this sample version is well-positioned in a booming market. Its combination of exclusivity, historical relevance, and rising value makes it a stable and appreciating investment in today’s collectible sneaker landscape.

Conclusion 🎯

The Nike Air Jordan 4 Undefeated 2017 sample offers a unique investment opportunity in the booming sneaker market. Priced well below recent auction results, it combines exclusivity, historical significance, and strong demand, making it an attractive option for investors. With steady market growth and flexible exit strategies, this rare sneaker is positioned for capital appreciation. Whether through private sale or auction, the asset offers potential for both short-term gains and long-term value. Given its cultural relevance and rising market prices, the sneaker provides an excellent balance of stability and growth potential in the collectible investment space.

Expert

I'm Constantin Philippi, a collector turned entrepreneur specializing in luxury collectibles since 2010. Explore my world of sneakers, art, toys, and modern treasures, each telling a unique story and serving as an investment. Every piece in my collection is a gateway to history, creativity, emotion, and potential profit.