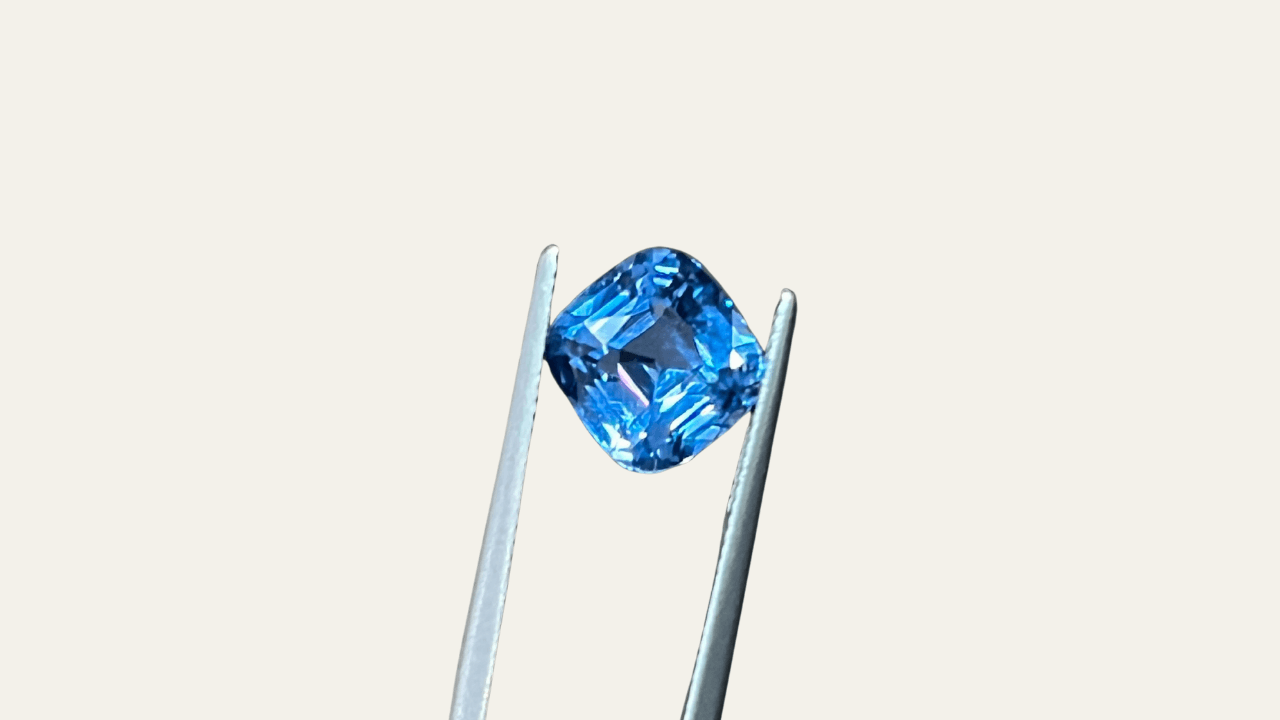

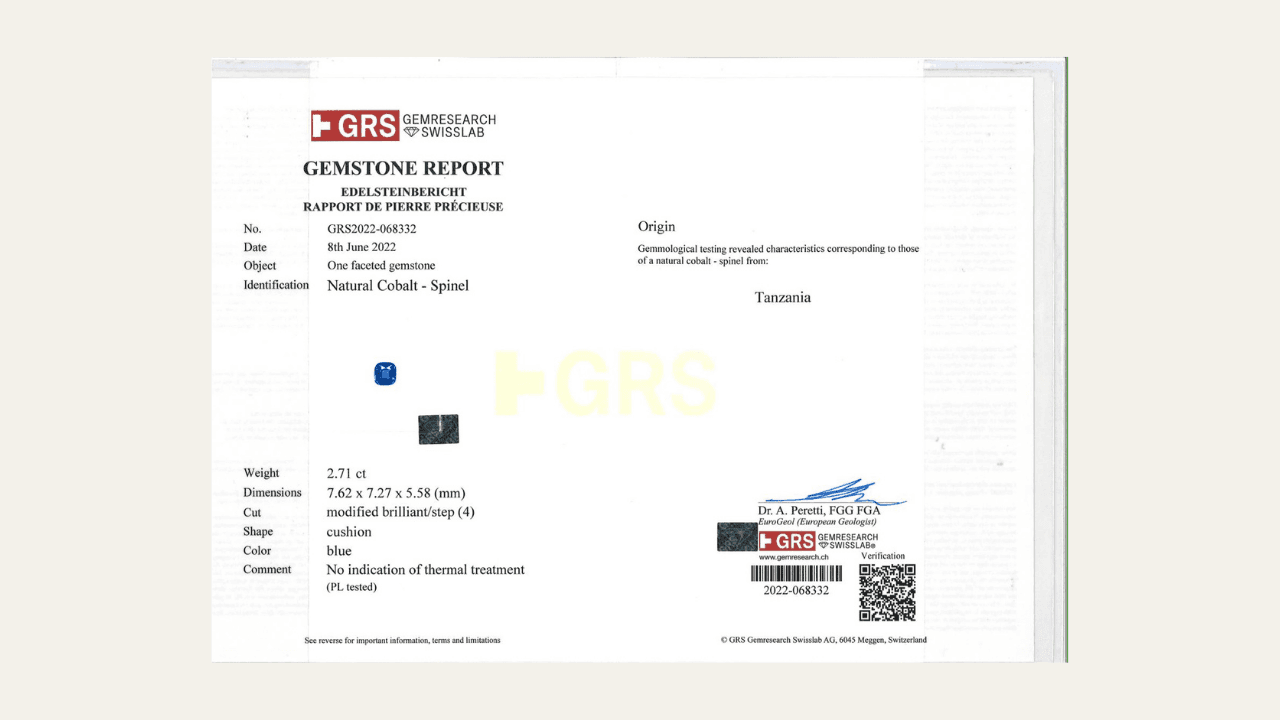

Natural Cobalt Spinel – no heat - 2.71 ct

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential: An investment of €500 could reach an estimated value of €1,291 in 7 years.

Cost-to-return ratio: After deducting 2.1% in annual total costs, your net return could reach 14.5% per year.

Exceptional Quality Meets Meaningful Size 💎: This stone combines eye‑clean clarity, vivid natural color, and a well‑proportioned cushion cut with a size that places it firmly above the norm for its category. High-quality stones of this caliber and scale are increasingly rare, making it especially attractive to collectors who prioritize purity, presence, and long-term desirability.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 5–7 years |

| Expected CAGR (Balanced) | 14.5% p.a. after fees |

| Optimistic CAGR | 17.9% p.a. after fees |

| Entry Discount | ~26% after fees vs. B2C benchmarks |

| Sharpe Ratio | 0.83 |

| Value at Risk (VaR) | 97.5% probability to exceed initial investment after 7 years |

| Standard Deviation | 17.23% |

| Risk Rating | A (8.8/10 – Moderate Risk) |

- 5–7 year horizon: Aligned with long-term appreciation cycles for rare, untreated cobalt spinels.

- 14.5% CAGR (balanced): Assumes a 60% probability of achieving the historical 16.2% CAGR (2015–2025), factoring in the 35% acquisition discount.

- 17.9% CAGR (optimistic): Based on an 80% probability of achieving the same historical CAGR, supported by strong scarcity dynamics.

- ~26% entry discount: Acquired at €33,500 after fees vs. B2C benchmark pricing.

- Sharpe Ratio 0.83: Attractive risk-adjusted return profile within the colored gemstone segment.

- VaR 97.5%: High confidence in capital preservation over the 7-year horizon.

- 17.23% standard deviation: Moderate volatility, based on 2010–2023 data and amplified by a 1.9x factor.

- Risk rating “A”: Strong overall rating driven by rarity, below-market entry, and favorable risk metrics.

Colored gemstones have long captivated investors and collectors alike, offering a unique blend of aesthetic beauty and financial security. Unlike traditional assets, their value is driven by rarity, cultural significance, and increasing global demand. The market for fine emeralds, sapphires, spinel and rubies has seen a steady appreciation, supported by limited supply and growing interest from emerging markets. Unlike diamonds, where synthetic alternatives pose a pricing challenge, top-tier natural colored gemstones maintain strong value retention due to their individuality and limited production. With auction records continuously being set, investing in premium colored gemstones is not just about appreciation—it’s about owning a tangible piece of history with enduring worth.

Cobalt spinel is among the most elusive and sought-after gemstones in the world, with Tanzania known for producing the highest-quality specimens. Unlike more abundant gems, cobalt spinel occurs only under unique geological conditions, making its appearance exceptionally rare. Its distinctive neon-to-violet blue hue, created by trace amounts of cobalt, is natural and untreated — a characteristic that significantly elevates both desirability and value.

What sets this specific 2.71ct spinel apart is not just its weight — which is impressive on its own — but also its unenhanced nature. In a market saturated with heat-treated gems, untreated stones hold premium status among collectors and connoisseurs, often commanding significantly higher auction prices. Furthermore, Tanzanian cobalt spinels are rarely found above 2ct in fine quality.

The stone’s crystalline clarity, combined with its vivid saturation and scarcity, places it at the intersection of luxury and investment potential. Much like fine art, these stones are admired not only for their beauty but for their store of value, particularly in uncertain markets where tangible assets with global appeal become safe havens.

In summary, this Cobalt Spinel represents a rare opportunity to invest in a high-grade, naturally occurring asset class whose supply is finite, whose beauty is undeniable, and whose trajectory in value has shown consistent growth.

This Cobalt Spinel offers a compelling combination of rarity, resilience, and return. With a 14.5% expected CAGR, low volatility, and a 97.5% chance of capital preservation, it stands out as a stable, alternative asset. Acquired below market value, it’s a premium long-term hold in a supply-constrained niche.

Expert

At CEYLONS | MUNICH , we redefine the essence of rarity. Our exclusive access to rare gemstones is matched only by our dedication to quality. Our commitment to excellence is rooted in our “mine to market” approach, ensuring a traceable journey from the source to your hands. By embracing a direct supply chain, we eliminate middlemen, placing you at the forefront of a seamless and trustworthy gemstone experience. Discover the allure of gemstones like never before, where each stone tells a tale of its journey, and every purchase reflects our unwavering commitment to value and authenticity.