Banksy, Banksquiat (Black), 2019

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €1,329 in 5 years.

Cost-to-return ratio⚖️: After deducting 3.3% in annual total costs, your net return could reach 21.6% per year.

A Hommage to Basquiat👑: Banksquiat presents a striking union between two of the biggest names in Street & Urban Art past and present: Jean-Michel Basquiat and Banksy.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 3–5 Years |

| Expected CAGR (Balanced) | 21.6% p.a. after fees |

| Optimistic CAGR | 27.1% p.a. after fees |

| Entry Basis | ~1.8% above verified market benchmarks for the black colour way print and after fees |

| Sharpe Ratio | 1.16 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 92.9% chance to exceed entry value after 3 years |

| Standard Deviation | 19.6% |

| Risk Rating | A (8.8/10 – Low–Moderate Risk) |

- 3–5 Year Horizon: Structured to benefit from recovery cycles and sustained global demand for Banksy’s most conceptually strong works.

- 21.6% CAGR (Balanced): Based on a 90% probability of replicating historical growth observed across comparable Banksy artworks between 2018 and 2022.

- 27.1% CAGR (Optimistic): Assumes a stronger rebound toward prior demand peaks while remaining below long-term market highs.

- ~1.8% Fair-Value Entry: Acquired at a validated market price supported by auction and private-sale benchmarks, limiting downside risk.

- Sharpe Ratio of 1.16: Indicates an exceptional risk-adjusted return profile, significantly outperforming traditional equity benchmarks.

- VaR 92.9%: Very high probability of exceeding entry value after three years, offering strong capital preservation.

- Standard Deviation (19.6%): Reflects low volatility relative to alternative assets and consistency with blue-chip contemporary art.

- Risk Rating “A”: Supported by 19 verified transaction data points and strong liquidity for Banksy’s established imagery.

Art has long been collected for its cultural, emotional, and economic value. Works by established contemporary artists offer strong demand, proven market depth, and broad institutional support. Investing in a blue-chip name like Banksy combines financial potential with the appeal of owning a culturally significant artwork, making this category attractive for both new and experienced collectors.

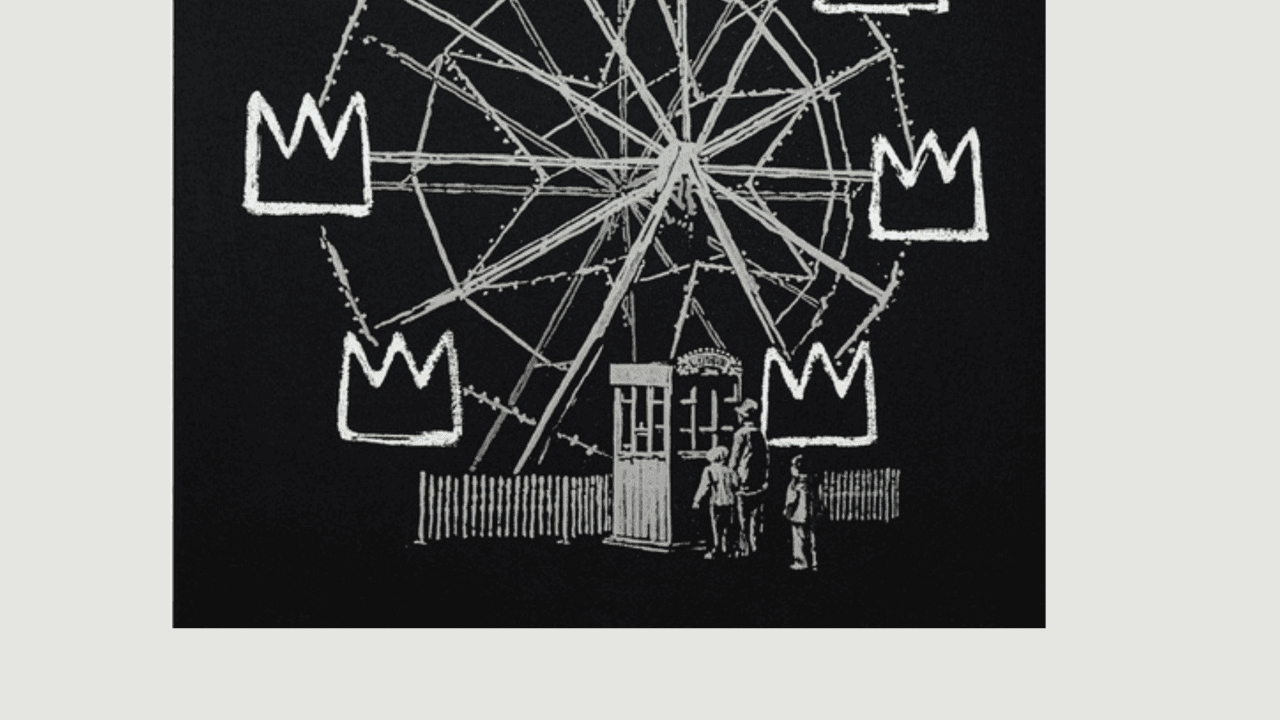

Banksquiat (Black), released through Banksy’s 2019 pop-up store Gross Domestic Product, represents a multi-layered homage to Jean-Michel Basquiat—both in visual language and ideological tension. The central motif, a Ferris wheel adorned with Basquiat’s iconic crowns, speaks to Basquiat’s recurring use of the crown as a symbol of artistic genius and royalty—particularly within the context of Black excellence in art. By reinterpreting this symbol as part of a consumerist carousel, Banksy delivers a satirical critique of how Basquiat’s legacy has been commodified in today’s art market—spinning endlessly in cycles of brand collaborations, merchandise, and commercial overexposure.

Yet, Banksquiat is more than just a commentary. It continues Banksy's tradition of merging tribute and irony, much like his earlier works referencing Haring or his Barbican murals during Basquiat’s retrospective. The work captures the paradox of cultural reverence and capitalist exploitation. Released in an edition of 300, its scarcity and narrative relevance have helped it achieve auction highs of £175,000, affirming both its artistic and financial value.

Now available at a ~75% discount to peak pricing, this piece offers a uniquely compelling entry point for collectors and investors alike. With a strong sales track record, deep symbolic resonance, and market liquidity, Banksquiat (Black) occupies a rare intersection of high-concept artwork and blue-chip contemporary asset. It’s not only a work of art—it’s a conversation, a critique, and a statement on the commodification of genius, making it a cornerstone acquisition in any forward-thinking collection.

Banksquiat (Black) combines cultural relevance, conceptual depth, and proven market liquidity. With strong downside protection, attractive risk-adjusted returns, and a compelling entry point below historical highs, it offers investors rare exposure to a blue-chip Banksy work that critically engages art history while delivering meaningful financial potential.

Expert

TGB London Limited, founded in 2016 by Simon Portlock and Bradley Ridge is an art advisory and brokerage company. Leveraging the expertise of Simon and Bradley in the contemporary art market, TGB specialises in guiding collectors to curate world-class art collections. With a commitment to excellence, TGB provides unparalleled insights and support to art collectors ensuring the creation of exceptional and noteworthy collections.