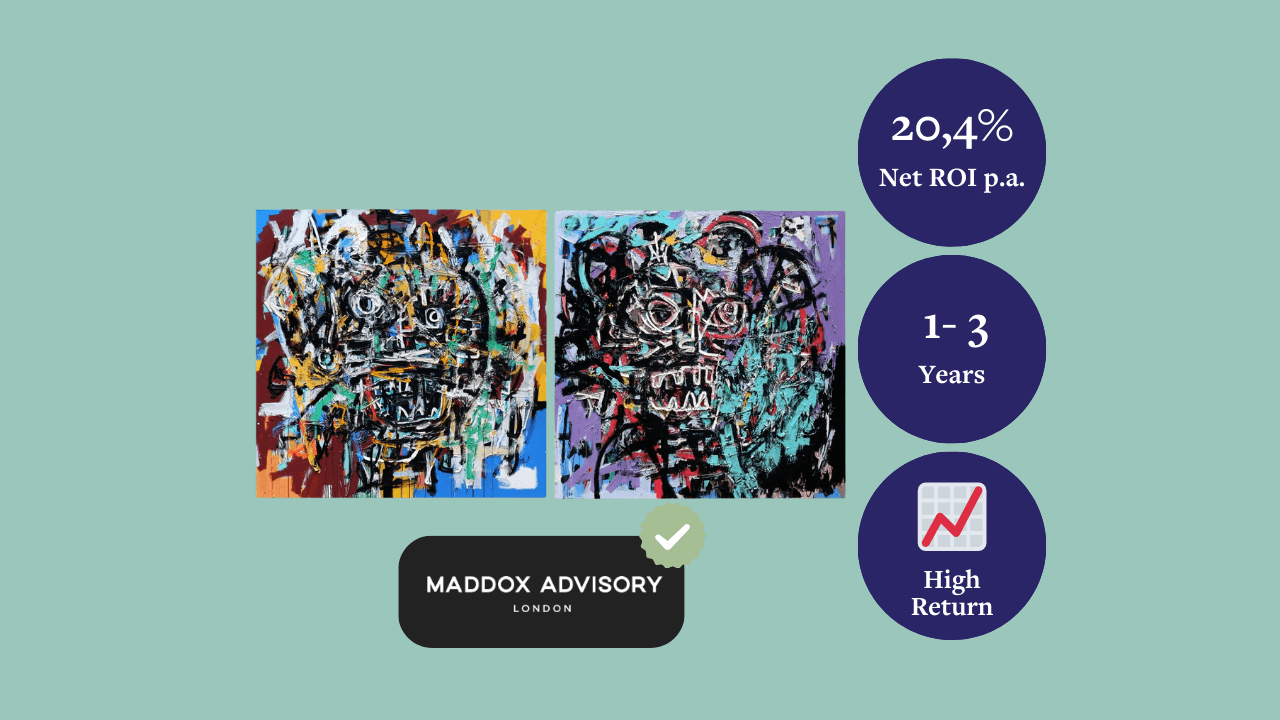

Fika Leon, Study of Faces 1 and 2, 2024

Main reasons to invest

Return Potential📈: An investment of 500 EUR is projected to be worth approximately 873 EUR in 3 years.

Cost-to-Return Ratio⚖️: After deducting 3.5% in annual total costs (including exit fees), your net return could reach 20.4% per year.

A Connection to Culture and Storytelling 🎨: Investing in Fika Leon’s paintings means embracing a unique blend of Southeast Asian heritage and modern expression. Each piece resonates with personal and cultural narratives, offering collectors not just art, but a profound journey through vibrant colors, bold forms, and deeply layered storytelling.

Description

Valuation Summary 📝

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent gallery transactions and auction results. Our analysis confirmed that the price offered, inclusive of all associated fees, is highly competitive. To estimate the potential ROI, we used the average annualised price increase of the paintings over the past years. For our conservative scenario, we assumed the value of the painting would grow at the rate of Swiss inflation, reflecting a defensive approach. In the balanced scenario, we assume a 100% probability of achieving a 14.7% annual return over the next 3 years (based on the average annualised return over the past year). Finally, in the ambitious scenario, we assume a 100% probability of achieving a 27.5% annual return over the next three years (based on the average annualised return for similar sized works over the past two years). These potential returns over the next three years for both the balanced and ambitious scenarios are further enhanced by the 25% discount to the current gallery price (for similar-sized works created in the 2000s) at which the painting is offered.

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the prevailing market situation, the painting will be sold to a private collector or offered as a single lot at an auction for contemporary art. An auction is considered if the price has developed to the point where the minimum bid matches the market value and there is high demand for works by the artist. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Why Invest in This Category? 🎨

For centuries art was collected for its cultural, emotional, intellectual, political, and economic value. Investing in emerging artists offers a mix of financial potential and personal satisfaction, making it an appealing option for both new and seasoned collectors.

Why Invest in This Asset? 💎

Investing in Fika Leon’s artwork offers a compelling opportunity due to his unique blend of cultural resonance, auction success, and growing demand among prominent collectors and galleries. As an emerging Southeast Asian artist, Leon captures universal themes with a distinct Indonesian perspective, appealing to both regional and international audiences. His auction record, exemplified by the £88,200 sale of Family Portrait in Safari Park, which far exceeded expectations, underscores rising market demand. Moreover, his representation by prestigious galleries and his endorsement by collectors like Michael Lee and Arushi Kapoor add credibility and stability, signaling continued upward momentum.

Leon’s artistic style combines abstract forms with traditional techniques, layered with rich colors and cultural motifs, making his work distinctive in the contemporary art scene. This unique fusion not only enhances marketability but also aligns with current trends favoring culturally diverse and thought-provoking art. Despite recent art market fluctuations, Leon’s positioning and discounted market entry price present a balanced opportunity for value appreciation over time, supported by an expanding collector base and consistent exhibition success. For collectors and investors seeking long-term appreciation and cultural value, Fika Leon's work offers a well-rounded investment in an artist gaining significant international traction.

Context in Time ⏳

Fika Leon’s work is emerging at a pivotal time in the art market, where global interest in Southeast Asian artists is steadily increasing. This shift aligns with a growing appreciation for cultural diversity and unique perspectives in contemporary art, as collectors and galleries seek fresh, distinct voices. Additionally, Leon's auction success and representation by notable galleries occur amid a broader resurgence in demand for narrative-driven, culturally infused artwork. While the art market faces recent volatility, Leon's entry into prestigious venues and his appeal to prominent collectors position him well for sustained interest and potential appreciation over the coming years.

Conclusion 🎯

Fika Leon’s artwork offers a balanced investment opportunity, combining cultural significance with strong market appeal and gallery endorsements. His distinct style, auction success, and expanding collector base underscore his rising prominence in contemporary art. With a discounted entry price, this investment aligns well with both appreciation potential and the benefits of cultural asset diversification.

Expert

The art investment advisors of Maddox bring together years of specialist knowledge and practical experience with objective market analysis to offer their clients quality advice and consistent returns.