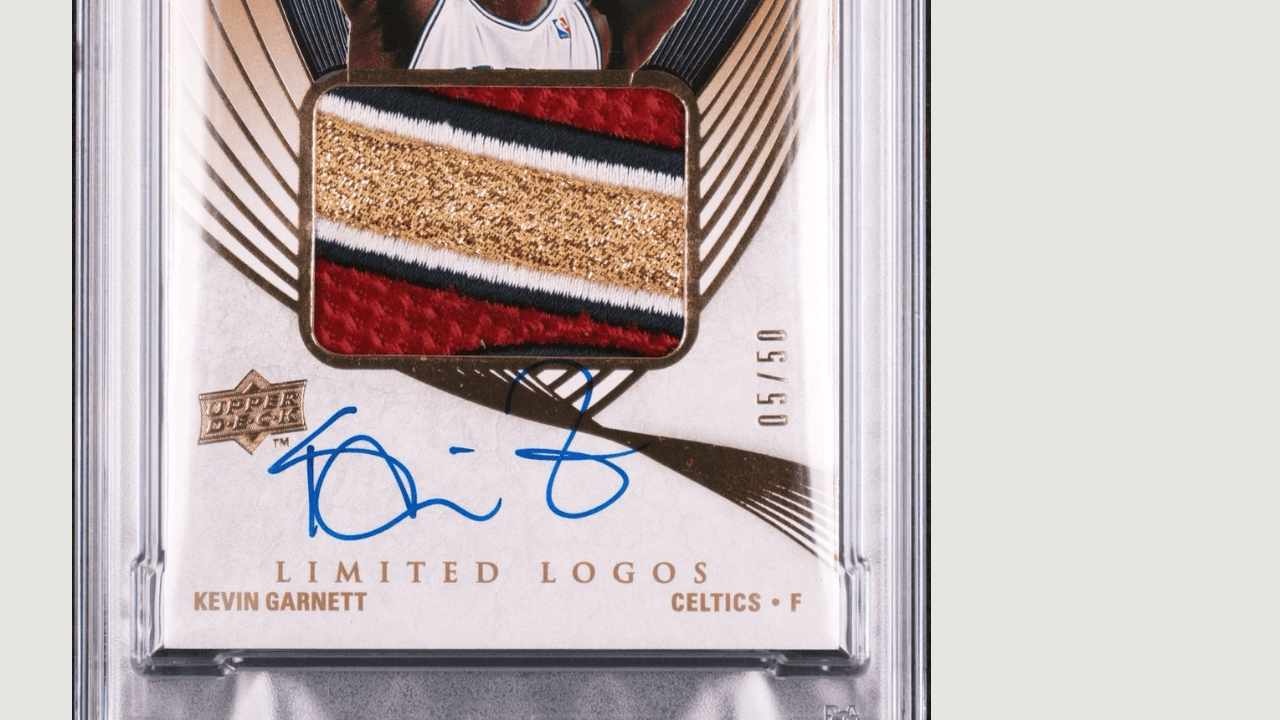

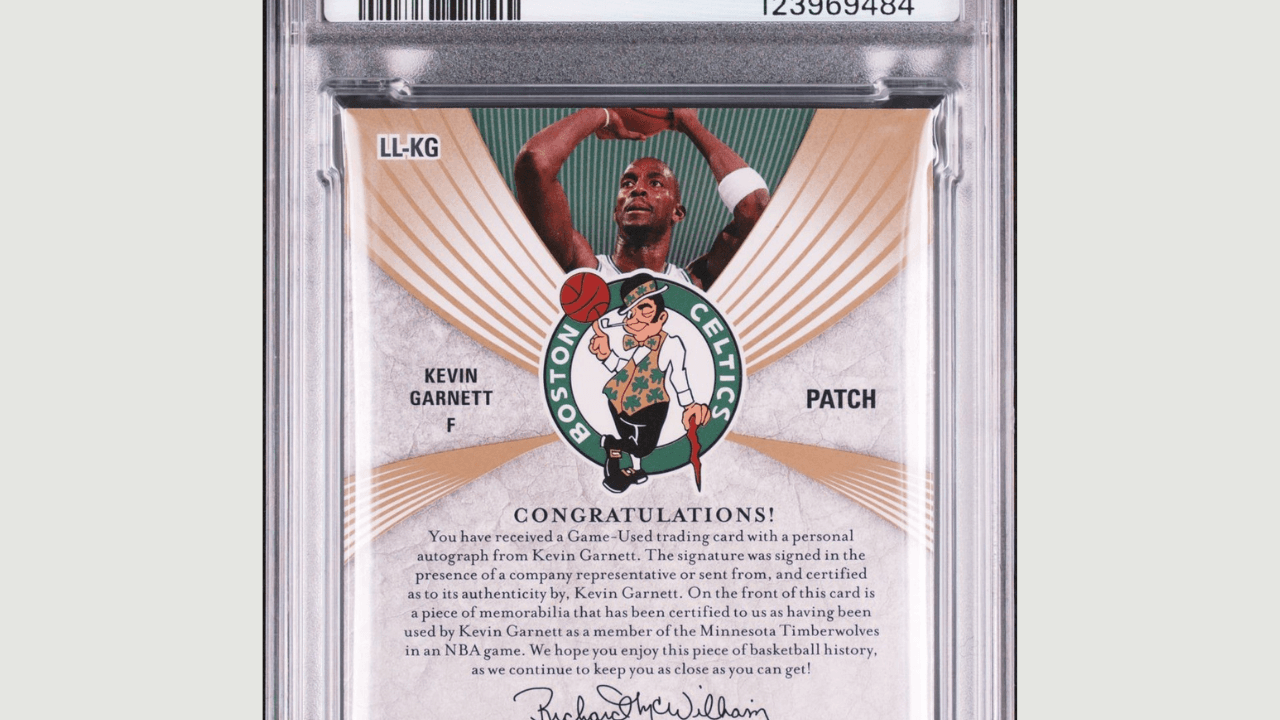

Kevin Garnett 2007 Exquisite Limited Logos 5of50 PSA 6 + 10 Auto

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of €500 could reach an estimated value of €1,864 in 5 years.

Cost-to-Return Ratio⚖️: With just 2.6% annual total costs, your net profit could be 30.1% per year.

Symbolic Rarity with Championship Legacy 🏆: This one-of-a-kind card pairs Garnett’s jersey number with a vibrant All-Star 8-break patch—symbolizing his 2008 triumph over Kobe. As the Celtics’ first title in over 20 years since 1986, it marks a historic comeback and defining moment in NBA history, captured in a single, iconic collectible.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 3–5 Years |

| Expected CAGR (Balanced) | 30.1% p.a. after fees |

| Optimistic CAGR | 46.7% p.a. after fees |

| Entry Basis | -1.2% vs. Fair Market Value |

| Sharpe Ratio | 0.85 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 91.6% chance to exceed €79,000 after 5 years |

| Standard Deviation | 36.1% |

| Risk Rating | B (7.6/10 – Moderate Risk) |

- 3–5 Year Horizon: Positioned to align with Garnett’s long-term brand equity and potential collector demand growth tied to Celtics legacy and Exquisite's historical significance.

- 30.1% CAGR (Balanced): Based on a full-weight application of the 33.3% observed average return from the Kevin Garnett CardLadder index—adjusted conservatively for general market volatility.

- 46.7% CAGR (Optimistic): Projects continued acceleration in demand for rare Garnett cards and stronger correlations with high-profile sales like the Kobe Limited Logos market.

- ~1.2% Entry Discount: The €79,000 entry price slightly undercuts the estimated FMV, which was determined using the premium gap between Kobe Exquisite sales and related comps like 2012 Prizm Gold /10.

- Sharpe Ratio of 0.85: Reflects a strong risk-adjusted return vs. traditional benchmarks like the SMI, indicating resilient upside against volatility.

- VaR 91.6% Confidence: Historical modeling shows a high probability of outperforming the initial entry price within the holding period, even in volatile conditions.

- Standard Deviation (36.1%): Reflects volatility in low-pop, high-grade KG Exquisite inserts; this level is consistent with niche markets where liquidity premiums and collector psychology dominate.

- Risk Rating “B (7.6/10)”: Assessed based on volatility, fair value certainty, track record, Sharpe ratio, and comparables. A strong mid-risk profile with meaningful upside potential.

We will manage the exit strategy in collaboration with our expert K3Y Asset on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the prevailing market situation, the card will be sold to a private collector or offered at an auction. An auction is considered if the price has developed to the point where the minimum bid matches the market value and there is high demand for works by the artist. Both options are carefully considered, and we will choose the one that maximizes the return for our investors.

Sports cards are an asset class that has enjoyed one of the highest multipliers in growth over the last 5 to 15 years among alternative investment vehicles. Sports cards have strong fundamentals in bringing high-valued licenses, age-tested brands, universal passion for sports, and transcendent talents together in innovative concepts.

Investing in the Exquisite Limited Logos brand—particularly the 2007 Kevin Garnett 5/50 card—offers a compelling opportunity at the intersection of prestige, symbolism, and scarcity. Exquisite is the original gold standard of modern basketball cards, establishing the first true ultra-premium tier with its on-card autographs, game-worn jumbo patches, and meticulous craftsmanship. Within the brand, the Limited Logos subset is particularly revered for offering the largest and most visually dominant patch windows among autographed patch cards. These attributes, combined with a limited print run, have made Exquisite Limited Logos the foundation of modern high-end collecting. It’s no coincidence that Exquisite also holds the record for the highest single card sale ever—cementing its place as an elite investment-grade brand.

The featured Garnett card is arguably the finest Celtics-era card of his career. Numbered 5/50, it directly aligns with his jersey number, creating a true “one-of-one” within the print run. The patch itself is not only vibrant but historic: an eight-color break from the 2008 All-Star Game—symbolizing Garnett’s triumph over Kobe Bryant during their NBA Finals clash that same year. The card’s production year also coincides with both Garnett’s only championship and Exquisite’s 5th anniversary, matching his serial and jersey number, adding layers of symbolism rarely seen in sports collectibles.

This card has not sold in public auction since 2022 and has only traded hands five times in the past decade—further underscoring its scarcity and long-term hold value. With a perfect autograph grade (10) and PSA 6 under strict modern grading standards, the card offers exceptional condition for a notoriously fragile set. When comparing against Kobe Bryant’s identical 5/50 card, which sold privately for $2.4M, Garnett’s version appears dramatically undervalued. Priced at roughly 1/30 of its Kobe counterpart, yet with arguably richer symbolism and matching attributes, this offering presents asymmetric upside.

With elite brand pedigree, unmatched symbolism, strong financial metrics, and exceptional scarcity, the 2007 Exquisite Kevin Garnett 5/50 offers a rare blend of collector prestige and investment potential. Backed by historical comps and favorable risk-return dynamics, this asset represents a uniquely asymmetric opportunity in the sports card market.

Expert

K3Y Asset is a hobby platform to tell stories in the hobby of card collecting in proper contexts and often in parallel to sports history and moments, while unlocking desirable attributes from key sports cards to elevate them into long term desirable assets.