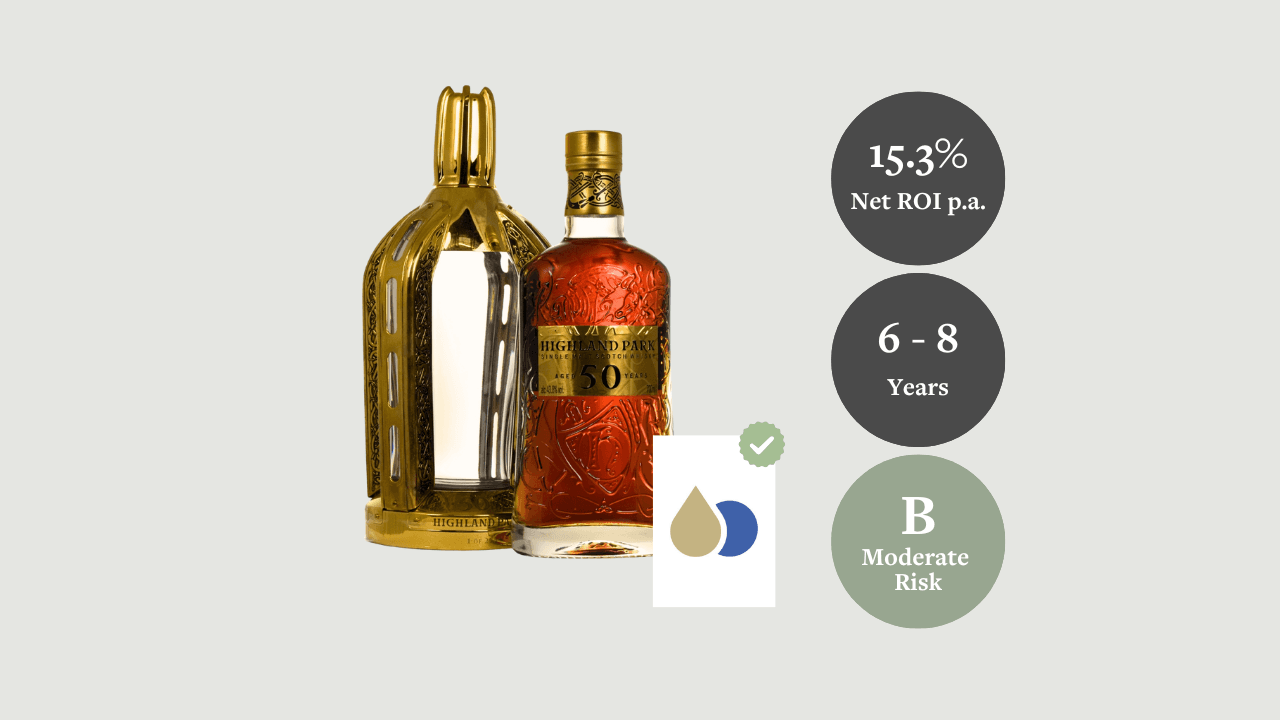

Highland Park 50 Year Old 2020 Release

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €1,556 in 8 years.

Cost-to-return ratio⚖️: With just 2.5% annual total costs, your net profit could be 15.3% per year.

The 1968 time capsule 🥃: This bottle holds half a century of Orkney climate, cask craft, and Highland Park’s blending tradition. The numbered decanter and Norse-inspired design make it a statement piece within the 50-Year series.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 6–8 years |

| Expected CAGR (Balanced) | 15.3% p.a. after fees |

| Ambitious CAGR | 18.5% p.a. after fees |

| Entry Basis | ~2.8% vs. auction-based fair value (Just Whisky Auction) |

| Sharpe Ratio | 0.79 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 97.1% chance to exceed €19,200 after 8 years |

| Standard Deviation | 19.3% |

| Risk Rating | B (7.6/10 - Moderate Risk) |

- 6 – 8 year horizon: Targeted to align with the long-term growth trend of ultra-aged Highland Park releases and the structural scarcity of bottles entering the market.

- 15.3% CAGR (balanced): Based on 80% replication of the Highland Park Index high-growth period (2013–2018), adjusted for current market liquidity and auction premiums.

- 18.5% CAGR (optimistic): Reflects continued appreciation of ultra-aged Scotch, supported by cross-market demand from Asian and European collectors.

- ~2.8% entry discount: The acquisition price of €19,200 sits slightly below the latest verified Just Whisky Auction result of 16,505 EUR, confirming a fair yet favourable entry position.

- Sharpe Ratio of 0.79: Demonstrates a strong risk-adjusted return relative to volatility, outperforming traditional benchmarks such as the Swiss Market Index (0.61).

- 97.1% VaR threshold: Indicates a high probability of the asset exceeding €19,200 after 8 years, supporting downside protection and stability.

- Standard deviation 19.3%: Moderate volatility compared to other collectible categories, reflecting consistent demand and limited availability of 50-year Highland Park bottles.

- Risk rating “B”: Classified as a moderately risky alternative asset with balanced exposure, steady liquidity, and a proven auction track record.

There are many reasons why investors should consider rare bottles of whisky as one of the best alternative investment opportunities. Rare whisky has been by far the top performer among luxury goods for some time. Its value has risen over 384% in the past 12-years and is not directly tied to stock market conditions. So while equities could experience significant price corrections, whisky would steadily increase in value over time.

There are many reasons why investors should consider rare bottles of whisky as one of the best alternative investment opportunities. Rare whisky has been by far the top performer among luxury goods for some time. Its value has risen over 384% in the past 12-years and is not directly tied to stock market conditions. So while equities could experience significant price corrections, whisky would steadily increase in value over time.

Presentation matters in ultra-aged Scotch. The decanter, designed by jewellery artist Maeve Gillies, carries Norse-inspired silver inlay and sits in a hand-crafted walnut case. Each bottle is individually numbered and signed by Master Whisky Maker Gordon Motion. The result reads as both fine whisky and collectible art, a dual appeal that expands the buyer pool beyond drinkers into long-term collectors.

Rarity is also structural. Only 274 bottles were produced. Liquidity remains steady across UK and EU auction houses, yet only a handful surface each year. Once placed in private collections, bottles seldom return, which tightens supply and supports price resilience over long holding periods.

Market references are clear: A 2025 Just Whisky Auction reached 16,505 EUR buyer price, validating current fair value estimates for the edition. Retail anchors sit materially higher, including The Whisky Exchange at 30,203 EUR and Das Gibt’s Nur Einmal at 29,999 EUR, with Whisky Stack sold out at 20,358 EUR. The expert offer at €19,200 reflects a 2.8% discount to that auction-based fair value, while total costs after fees imply a 16% premium that remains below current retail benchmarks.

For collectors and investors, this bottle pairs trusted brand equity with a proven auction record. The 6–8 year horizon aligns with ongoing scarcity, broad cross-market demand in Europe and Asia, and the time needed to realise series-level appreciation.

Highland Park 50 Years Old 2020 combines extreme rarity, respected branding, and verified market anchors. Its design elevates collectability. Auction and retail references frame a supportive price map for the 6–8 year window. With measured volatility and clear demand, it offers stable exposure to blue-chip ultra-aged Scotch.

Expert

Spiritory is an exchange-based live marketplace for whisky and spirits enthusiasts and collectors. The online platform enables users to trade coveted spirits in the simplest, most transparent and secure way possible.