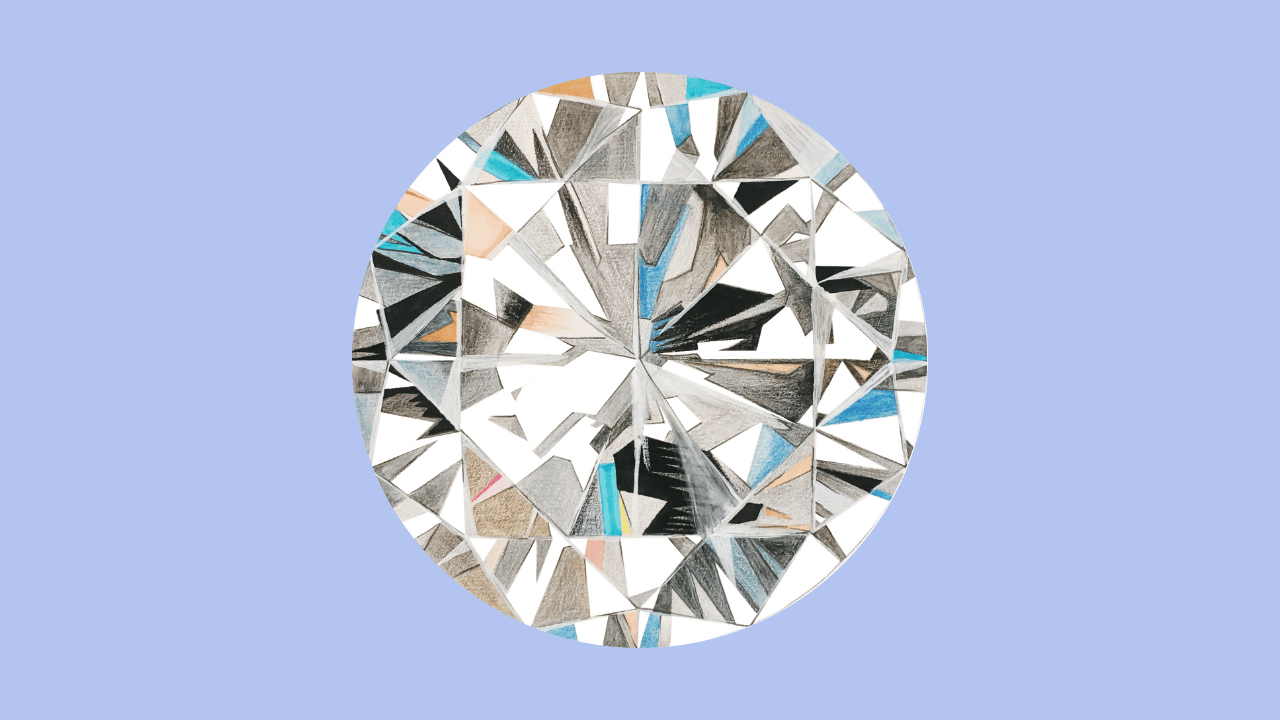

Diamond, Brilliant, 1.71 carat, D-FL

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of 500 EUR is projected to be worth approximately 715 EUR in 6 years.

Cost-to-Return Ratio⚖️: With just 2.1% annual total costs (including exit fees), your net profit could be 6.2% per year.

Highest Grade 💎: The diamond has three times the grade "Excellent" and has no fluorescence.

Description

⚠️New: We now provide you with the option to repurchase your splints at market value anytime. Please note that an additional processing fee will apply. The processing fee varies based on the volume, investment, and your holding duration. Use the contact form to initiate the process.

Why investing in Diamonds?

Tangible Asset

Diamonds are a tangible asset that you can hold in your possession. Unlike stocks or bonds, you can physically store and enjoy them.

Store of Value

Diamonds have been considered a store of value for centuries. They are durable and do not corrode, making them a reliable long-term investment.

Hedge Against Inflation

Like other tangible assets such as real estate and gold, diamonds can serve as a hedge against inflation. Their value may increase over time, keeping pace with or outpacing inflation rates.

Portability

Diamonds are highly portable and can be easily transported, making them a potentially valuable asset for international diversification.

Low Correlation

Diamonds may have a low correlation with traditional financial markets, meaning their value may not always move in sync with stocks, bonds, or other investments. This can be advantageous for diversification purposes.

Low Volatility

Brilliants with a weight of 1 to 2 carats show an annual volatility of less than 2% over the last 5 years.

Intrinsic Value

Diamonds have intrinsic value due to their rarity and the resources required for their extraction and processing. This value can provide some level of security to investors.

Why this Diamond?

Focus on Liquidity with regards to Size and Grade

Diamonds that are 1 to 2 carats in size and have a D-IF or D-Fl grade are considered high-quality diamonds that are very valuable in the jewelry industry and therefore more liquid than larger ones. These diamonds are often used in engagement rings or other high-end jewelry pieces as they are considered rare and valuable. The size of 1 to 2 carats is also a popular size for engagement rings as it provides a good balance between size and affordability.

D-FL highest Grade

The D-FL grade refers to the diamond's color and clarity. A D color grade is the highest grade given to a diamond and indicates that the diamond is completely colorless. FL, or Flawless, refers to the clarity of the diamond and means that the diamond is free from any internal or external blemishes or inclusions visible under 10x magnification.

Expert

Whether it's diamonds, gemstones, jewellery or watches, the swiss company The BrandZ ensures that its customers enjoy a unique and personal shopping experience - a luxury experience.

The BrandZ's suppliers, with whom a trusted relationship has existed for decades, own cutting facilities and mines around the world. Thanks to these partnerships, The BrandZ can access exceptional stock at the best prices.