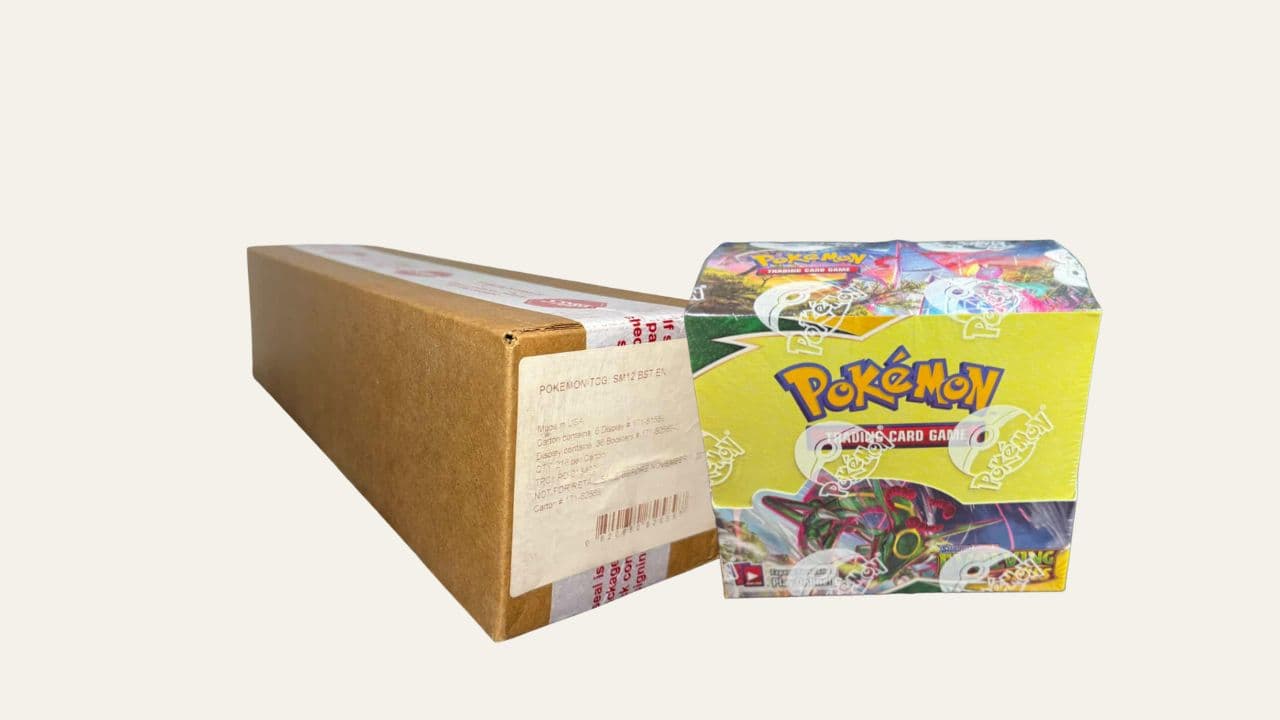

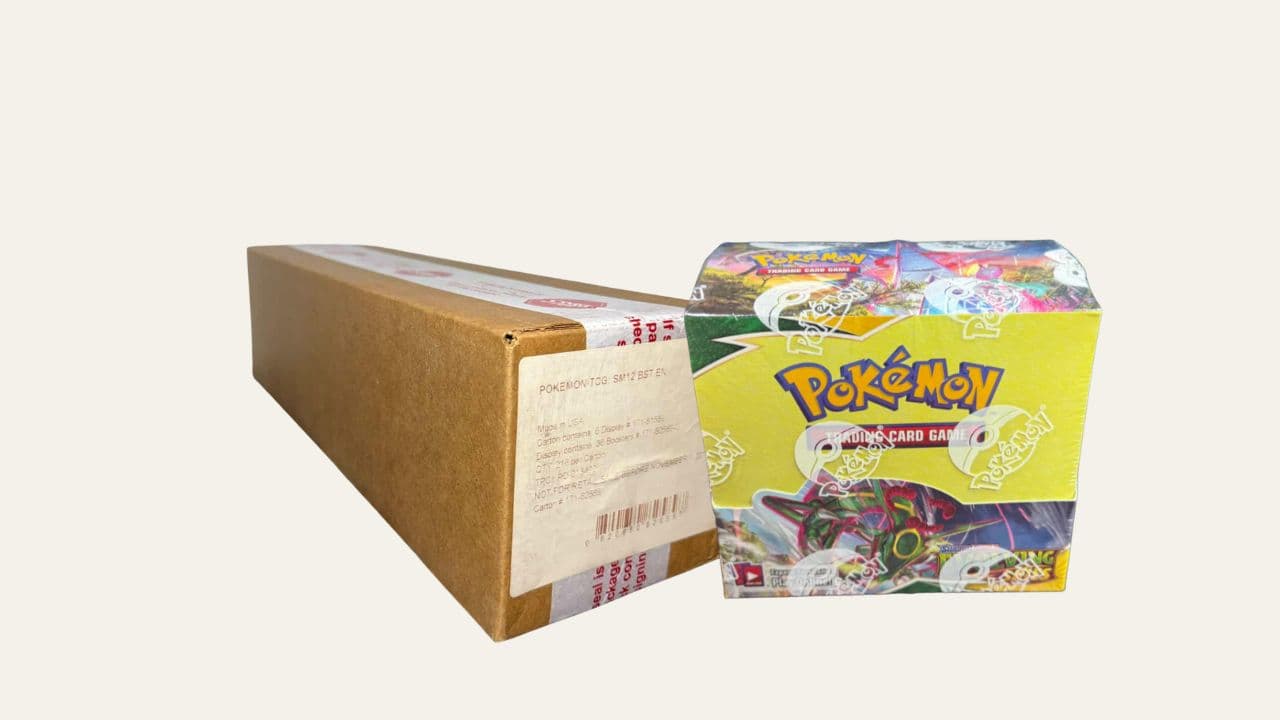

Pokémon, Evolving Skies (6 booster boxes, sealed case), 2021

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €1,883 in 6 years.

Cost-to-return ratio⚖️: After deducting 2.3% in annual total costs, your net return could reach 24.7 % per year.

The era’s crown jewel ✨: Evolving Skies sits at the top of the Sword & Shield era. Collectors still chase its Umbreon, Rayquaza, and Sylveon cards, which built its cult-level status. A sealed case preserves the full experience of the era at its peak. It appeals to collectors who want rarity, completeness, and long-term value in one place.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 4-6 Years |

| Expected CAGR (Balanced) | 24.7% p.a. after fees |

| Ambitious CAGR | 33.7% p.a. after fees |

| Entry Basis | ≈4% below fair value |

| Sharpe Ratio | 0.64 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 85% chance to exceed €17,600 after 6 years |

| Standard Deviation | 38.9% |

| Risk Rating | B (7.2/10 - Moderate Risk) |

- 4 – 6 year horizon: Targets long-term appreciation as sealed Sword & Shield products become harder to source and demand for Evolving Skies continues to strengthen.

- 24.7% CAGR (balanced): Based on applying 30% of the 91.4% CAGR observed for Evolving Skies sealed cases between October 2023 and November 2025.

- 33.7% CAGR (optimistic): Reflects stronger demand for sealed modern Pokémon cases, reinforced by the set’s flagship chase-card lineup and continued supply contraction.

- ~4% entry discount: The acquisition price sits slightly below current median eBay and marketplace valuations after fees, providing a favourable entry position.

- Sharpe ratio of 0.64: Indicates a moderate risk-adjusted return relative to volatility and comparable to the 5-year SMI benchmark of 0.61.

- 85% VaR threshold: Suggests a high probability of exceeding €17,600 after six years, supporting meaningful downside protection.

- Standard deviation (38.9%): Represents elevated volatility typical for modern sealed collectibles with strong demand but limited long-term price history.

- Risk rating “B”: Classified as a moderately risky asset with strong fundamentals, clear scarcity, and long-term appreciation potential driven by collector demand..

Pokémon sealed displays have built a strong record of stable demand and clear price history. They offer transparent market data, wide collector interest, and predictable long-term scarcity. The Sword & Shield era, and Evolving Skies in particular, now attracts growing attention as one of the defining modern sets. Intact sealed cases are becoming harder to source, which supports long-term value for collectors who focus on preserved, untouched product.

The Sword & Shield – Evolving Skies Sealed Case stands at the top of modern Pokémon collecting. Its reputation comes from a mix of iconic alternate-art cards, strong character appeal, and a proven track record of price appreciation since its 2021 release. The set quickly became the flagship expansion of the era, driven by its Eeveelution lineup, its Dragon-type returns, and its standout artwork. These elements shaped a loyal global fan base that continues to support demand.

While individual booster boxes remain active on the secondary market, full sealed cases have become increasingly scarce. Many were opened during release windows, broken into boxes for short-term sales, or absorbed into long-term private collections. The result is a shrinking supply of verifiable, factory-sealed cases. This scarcity creates a meaningful distinction between owning a single box and owning a sealed case of six. Collectors value the preserved provenance, consistent condition, and long-term storage appeal that only full cases provide.

Market data from 2023 to 2025 confirms steady liquidity. Booster boxes continue to sell across major marketplaces with healthy volume. Verified sealed cases appear rarely and move quickly, reflecting a supply-constrained environment. At the same time, demand for the set remains resilient due to its most notable chase cards — Umbreon VMAX, Rayquaza VMAX, Glaceon VMAX, Sylveon VMAX – which rank among the highest-valued alternate-arts in the modern era.

The momentum of the Sword & Shield era adds another layer. Collectors increasingly view this generation as a future classic. As Pokémon shifts deeper into Scarlet & Violet, the likelihood of a reprint decreases, supporting continued scarcity. Combined with the sealed case’s preserved integrity and strong collector preference, these factors form a persuasive foundation for long-term value growth.

The sealed Evolving Skies case combines rarity, strong historical growth, and deep collector appeal. With steady demand, limited supply, and top-tier chase cards, it stands out as a resilient long-term item. Its performance across multiple market cycles supports a compelling outlook for collectors seeking both enjoyment and appreciation potential.

Expert

Collectomat GmbH mainly sells trading cards in ultra-modern vending machines. In addition to classics such as Pokémon, the vending machines also offer boosters from One Piece, Disney, Sport, YuGiOh! and other formats.