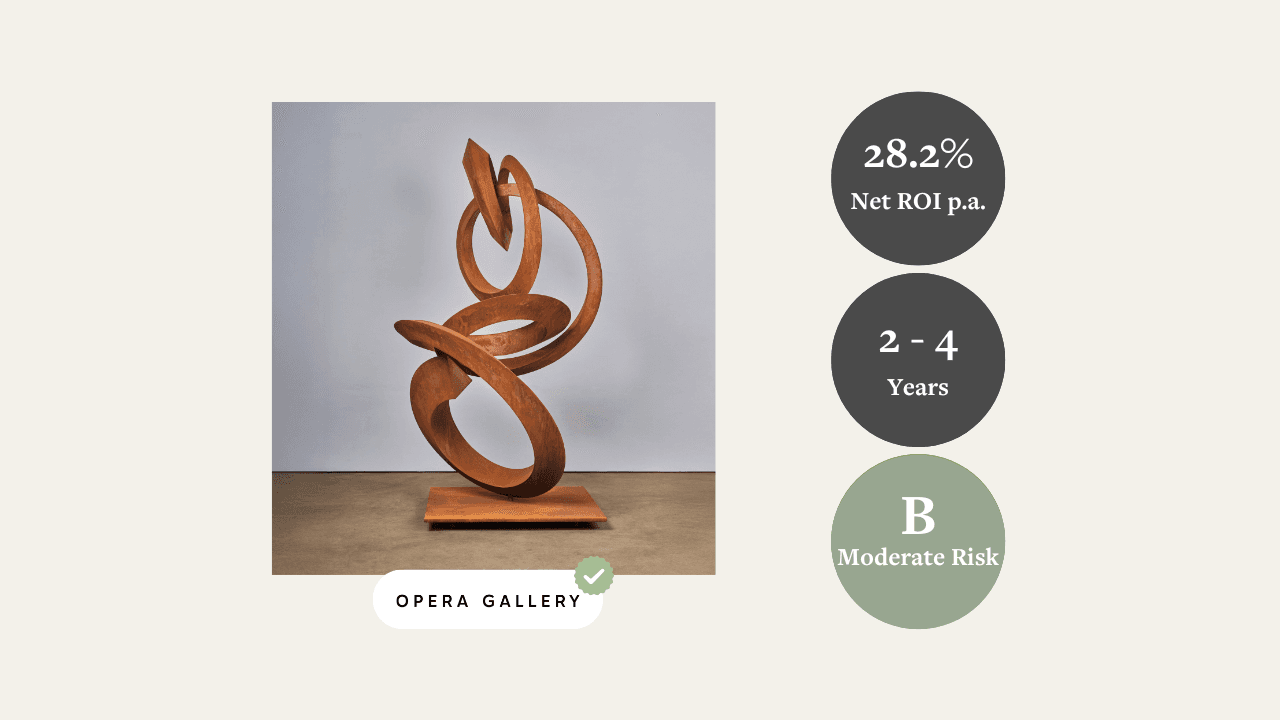

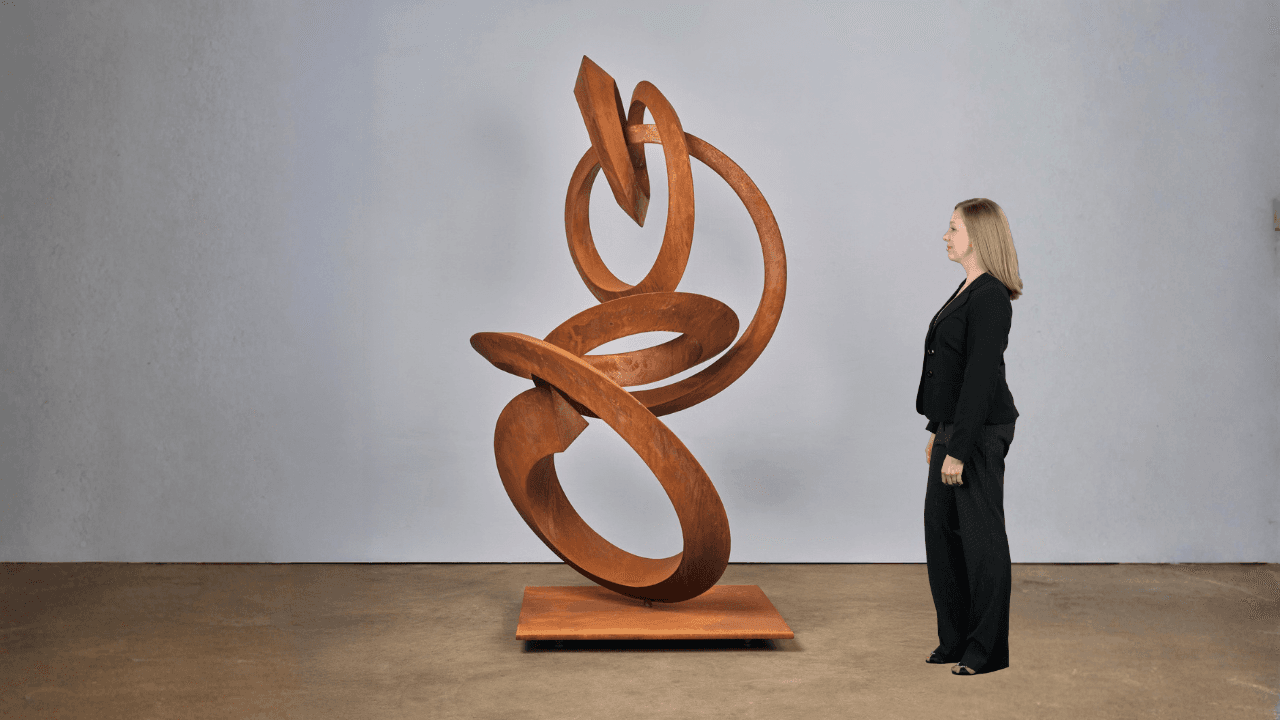

Pieter Obels, Go Whisper Softly, 2025

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of €500 could reach an estimated value of €1,351 in 4 years.

Cost-to-Return Ratio⚖️: With just 2.7% annual total costs, your net profit could be 28.2% per year.

Timeless Curves in Steel 💡: Obels' work evokes softness through steel, drawing collectors toward a more harmonious visual world. Acquired at a 33.7% discount to the latest auction result—its total cost remains 26.6% below market after fees. Validated by gallery quotes, this offers strong entry value for a rare, institutionally recognized sculpture.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 2–4 years |

| Expected CAGR (balanced) | 28.2% p.a. after fees |

| Optimistic CAGR | 35.8% p.a. after fees |

| Entry Discount |

Entry discount of 33.7% (prior to fees) |

| Sharpe Ratio | 0.93 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 93.4% probability of exceeding initial investment price |

| Standard Deviation | 28.8% |

| Risk Rating | B (7.6/10 – Moderate Risk) |

- 2–4 Year Horizon: Aligned with Obels’ expanding institutional visibility and strong demand from collectors of monumental sculpture, the holding period targets exit between 2028 and 2030.

- 28.2% CAGR (Balanced): Based on 60% probability of replicating the 36.2% CAGR observed across comparable sculptures (2017–2025) and including a discount of 33.7%.

- 38.4% CAGR (Optimistic): Based on 80% probability of replicating the 36.2% CAGR observed across comparable sculptures (2017–2025) and including a discount of 33.7%.

- Entry Discount of 33.7%: A 33.7% discount compared to the July 2025 auction result of €104,493 for a similar-sized sculpture. Pricing is supported by gallery quotes and recent collector market activity.

- Sharpe Ratio of 0.93: A robust risk-adjusted return that exceeds the Swiss Market Index benchmark (0.61), highlighting the efficiency of this entry point.

- 93.4% VaR Threshold: Forecasts show a 93.4% chance that the sculpture will exceed the initial investment price after 4 years, offering solid downside protection.

- 31.0% Volatility: The standard deviation reflects moderate price fluctuations comparable to leading mid-career artists—appropriate for collectors seeking appreciation with measured risk.

- Risk Rating “B”: Obels scores well across entry pricing, volatility, institutional demand, and recent performance—justifying a moderate risk profile.

In collaboration with our experienced Opera Gallery, we handle the exit strategy on behalf of our investors to ensure the best possible outcome under current market conditions. Depending on market dynamics, the artwork will either be sold to a private collector or offered as a single lot at a contemporary art auction. An auction will be considered if price developments support a reserve price aligned with market value and strong demand for the artist’s work exists. Both options will be carefully evaluated, and we will choose the one that maximizes returns for our investors.

Why Invest in This Category? 🎨

For centuries, art has been collected for its cultural, emotional, intellectual, political, and financial value. Investing in a mid-career artist offers a combination of financial potential and personal satisfaction, making it an attractive option for both new and seasoned collectors.

Why Invest in This Asset? 💎

Pieter Obels’ “Go Whisper Softly” stands out not only for its craftsmanship but also for its positioning within the international art market. Created in 2025 and acquired directly from the artist, this unique work features Obels’ signature material, Corten steel, known for its natural weathering and the patina that develops over time. Unlike cast works, “Go Whisper Softly” is entirely hand-shaped — there is no duplicate — highlighting both the rarity and authenticity of the piece.

Its impressive dimensions (220 x 160 x 128 cm) and organic aesthetic make it an appealing centerpiece for both public and private installations. Obels has an extensive exhibition history at renowned institutions such as Opera Gallery Dubai, Art Paris, and The Valley in Amsterdam. His works are not only sold out on platforms like Artsy but are also part of numerous corporate and municipal collections across Europe.

This work was acquired with a 33.7% discount compared to a comparable auction result from July 2025, ensuring a strong margin of safety. With no expected variable holding costs and highly durable material, the sculpture is structurally and financially well-suited for a mid-term holding position.

Obels combines rarity, public recognition, and long-term aesthetic relevance. With institutional placements across Europe, zero variable costs, and high market absorption, “Go Whisper Softly” is well-positioned to achieve significant value appreciation by 2029.

Expert

Founded in Singapore in 1994, Opera Gallery has forged, over its 30 years, a network of 16 galleries worldwide including London, Paris, New York, Geneva, Hong Kong, and Seoul, establishing itself as one of the leading global players within the international art market. Headed by Gilles Dyan, Opera Gallery specialises in post-war French art, and in Modern and Contemporary European, American, and Asian art. In addition, the gallery represents international emerging artists such as Andy Denzler, Anthony James and Gustavo Nazareno. and more established contemporary artists such as Ron Arad, Manolo Valdés, and Anselm Reyle.