Sold out

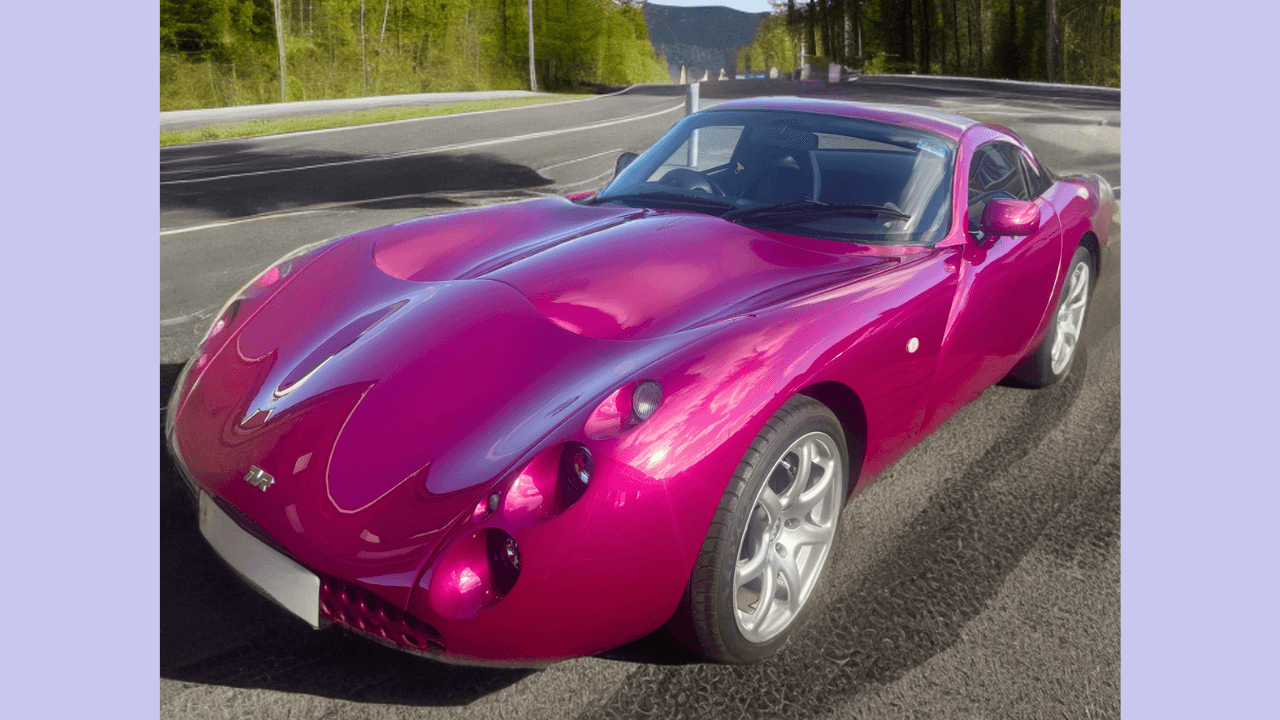

2001 TVR Tuscan

Asset value

57.005,00 €

Earning potential

13.95%

Splints left

0/1.069

Investment horizon in years

1-3

Return-to-Risk Assessment

8/10

Performance since release

+6.7%

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return Potential📈: An investment of 500 EUR is projected to be worth approximately 741 EUR in 3 years.

Cost-to-Return Ratio⚖️: After deducting 3.5% in annual total costs (including exit fees), your net return could reach 14.0% per year.

U.S. Import Opportunity 🚗📈: Our TVR Tuscan is poised for a potential 30-40% price increase next year as it becomes eligible for U.S. import, following the trend of other classic cars reaching the 25-year mark.

Description

Valuation Summary 📝

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent transactions and current market values across the UK, EU, and US. Our analysis confirmed that the price offered, inclusive of all associated fees, is still highly competitive. To estimate the potential ROI, we used the historical performance data of this specific TVR model. For our conservative scenario, we assumed the value of the car would grow at the rate of Swiss inflation, reflecting a defensive approach. In the balanced scenario, we calculated the average historical 5-year growth rate (UK) including the expected additional historical growth rate of similar cars (Ferrari 550 Maranello, Jaguar XJ220, Lotus Elise S1 (average price increase after eligibility of US export 31%) due to import eligibility in the US. Finally, in the ambitious scenario, we e calculated the average historical 5-year growth rate (UK) including the expected additional historical growth rate of TVR Cerbrera (+75%) due to import eligibility in the US.

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the car's value and the prevailing market situation, we can either sell the TVR Tuscan privately to a collector or take it to auction. As the car was never delivered to the US, selling there could yield significant returns due to high demand and rarity.

Why Invest in This Category? 🚗

Classic cars remain one of the top-performing luxury asset classes, with a strong track record of appreciation. The demand for iconic models like the TVR Tuscan continues to grow, driven by limited supply and increasing global interest, especially in the US, where it was never exported.

Why Invest in This Asset? 💎

The TVR Tuscan presents a unique investment opportunity due to its limited production, iconic status, and future export potential. With only around 1,677 units produced and its 25-year US import eligibility approaching, the Tuscan is poised to see a significant value appreciation in the coming years.

Context in Time ⏳

The TVR Tuscan was introduced during the late 1990s and early 2000s, a period when TVR embraced bold, unconventional designs and raw driving performance. As it nears 25 years of age, demand is growing, particularly with U.S. collectors eager to acquire this rare and striking model.

Conclusion 🎯

Investing in the TVR Tuscan offers a blend of rarity, cultural significance, and solid potential for future appreciation. With increasing demand, especially from the U.S., the Tuscan is set to deliver strong returns for collectors and investors alike as it becomes eligible for global markets.

To ensure the competitiveness of the investment, we conducted a thorough verification of the purchase price by analyzing recent transactions and current market values across the UK, EU, and US. Our analysis confirmed that the price offered, inclusive of all associated fees, is still highly competitive. To estimate the potential ROI, we used the historical performance data of this specific TVR model. For our conservative scenario, we assumed the value of the car would grow at the rate of Swiss inflation, reflecting a defensive approach. In the balanced scenario, we calculated the average historical 5-year growth rate (UK) including the expected additional historical growth rate of similar cars (Ferrari 550 Maranello, Jaguar XJ220, Lotus Elise S1 (average price increase after eligibility of US export 31%) due to import eligibility in the US. Finally, in the ambitious scenario, we e calculated the average historical 5-year growth rate (UK) including the expected additional historical growth rate of TVR Cerbrera (+75%) due to import eligibility in the US.

Exit Options at Maturity 🚪

We will manage the exit strategy on behalf of our investors, ensuring the best possible outcome based on market conditions at the time. Depending on the car's value and the prevailing market situation, we can either sell the TVR Tuscan privately to a collector or take it to auction. As the car was never delivered to the US, selling there could yield significant returns due to high demand and rarity.

Why Invest in This Category? 🚗

Classic cars remain one of the top-performing luxury asset classes, with a strong track record of appreciation. The demand for iconic models like the TVR Tuscan continues to grow, driven by limited supply and increasing global interest, especially in the US, where it was never exported.

Why Invest in This Asset? 💎

The TVR Tuscan presents a unique investment opportunity due to its limited production, iconic status, and future export potential. With only around 1,677 units produced and its 25-year US import eligibility approaching, the Tuscan is poised to see a significant value appreciation in the coming years.

Context in Time ⏳

The TVR Tuscan was introduced during the late 1990s and early 2000s, a period when TVR embraced bold, unconventional designs and raw driving performance. As it nears 25 years of age, demand is growing, particularly with U.S. collectors eager to acquire this rare and striking model.

Conclusion 🎯

Investing in the TVR Tuscan offers a blend of rarity, cultural significance, and solid potential for future appreciation. With increasing demand, especially from the U.S., the Tuscan is set to deliver strong returns for collectors and investors alike as it becomes eligible for global markets.

Expert

TheCarCrowd

The mission at TheCarCrowd is to give investors across the globe the opportunity to invest in one of the World’s fastest appreciating asset classes.

Additional details

Asset ID

ce279ff9-e680-4668-9a1b-65e20da661a8

Brand

TVR

Model

Tuscan

Registration date

2001

Kilometer

36,000 km

Power

360 bhp

Transmission

6-speed manual gearbox

Condition

1 excellent