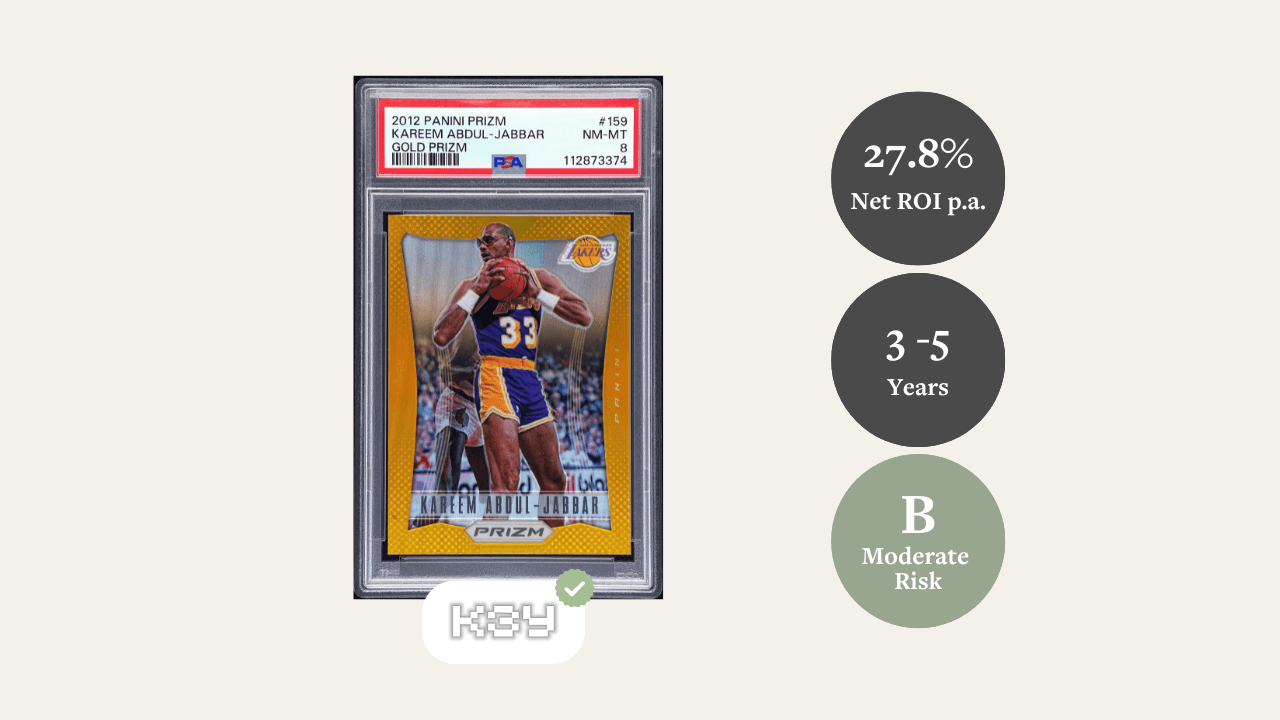

Kareem Abdul-Jabbar 2012 Panini Prizm Gold 10of10 PSA 8

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €1,708 in 5 years.

Cost-to-return ratio ⚖️: After deducting 2.5% in annual total costs, your net return could reach 27.8% per year.

Skyhook in gold 🏀: For many fans, Kareem’s skyhook is the single most recognisable move in basketball history. This card freezes that motion in a clean Prizm Gold design from 2012, the first year of the set. Only ten copies exist, and this one carries the last serial number, 10/10. It feels less like a trading card and more like a small, golden monument to 20 years of dominance.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 3–5 Years |

| Expected CAGR (Balanced) | 27.8% p.a. after fees |

| Ambitious CAGR | 48.0% p.a. after fees |

| Entry Basis | fair value range (53,676 - 67,755 EUR) |

| Sharpe Ratio | 0.81 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 88.7% chance to exceed €67,500 after 5 years |

| Standard Deviation | 35.1% |

| Risk Rating | B (7.6/10 - Moderate Risk) |

- 3–5 year horizon: Targets a mid-term window in which demand for first-year Prizm Gold and GOAT-tier players continues to rise.

- 27.8% CAGR (balanced): Based on 30% replication of the 103.3% CAGR observed in a key Panini Prizm Gold comparable.

- 48.0% CAGR (optimistic): Reflects strong momentum for premium Prizm Gold cards and growing interest in Kareem’s modern grails.

- Fair entry position: The expert price of [VAR] EUR sits inside a fair value range of 53,676 to 67,755 EUR, based on two Prizm Gold comparables.

- Sharpe ratio 0.81: Outperforms the 5-year SMI benchmark (0.61), indicating a strong risk-adjusted return.

- 88.7% VaR threshold: High probability of exceeding 67,500 EUR after 5 years, offering meaningful downside protection.

- Standard deviation (35.1%): Reflects typical volatility for scarce, high-end basketball cards with global buyer pools.

- Risk rating “B”: Moderate-risk asset supported by GOAT-level legacy, true scarcity, and broad collector demand.

Sports cards are an asset class that has enjoyed one of the highest multipliers in growth over the last 5 to 15 years among alternative investment vehicles. Sports cards have strong fundamentals in bringing high-valued licenses, age-tested brands, universal passion for sports, and transcendent talents together in innovative concepts.

Kareem Abdul-Jabbar sits near the top of any all-time ranking. Six MVPs, six championships, a scoring record that stood for 33 years, and a signature move that still has no real counter. Yet his modern card portfolio is surprisingly thin. He has almost no premium logoman cards, very few high-end patches, and far fewer Prizm appearances than many younger stars.

That gap creates the first pillar of the investment case. Demand for Kareem as a legend is wide. Supply of true premium modern cards is narrow. This 2012 Prizm Gold 10/10 helps close that gap.

The second pillar is the set itself. 2012 Panini Prizm Gold is widely seen as the flagship modern basketball parallel. It is the debut year, and gold /10 is the key chase. Only ten copies exist for each player. Here, Kareem appears in his classic Lakers uniform with the skyhook loading up. Within modern cards, this is as close as it gets to a “textbook” Kareem image.

The third pillar is the serial and grade. The card is numbered 10 of 10, the last and often most desired serial in a run. It holds a PSA 8 grade, which matters less for ultra-scarce gold parallels than for mass-printed rookie cards. For a run with ten copies, ownership counts more than one extra grade point. The PSA case still gives buyers confidence in authenticity and condition.

Value at Risk modelling shows an 88.7% probability that the card exceeds 67,500 EUR after five years. The expert price of 60,000 EUR falls inside a fair value range of 53,676 to 67,755 EUR, based on two Prizm Gold comparables tracked on CardLadder. That suggests a fair entry point with room for re-rating if demand for Kareem’s modern grails catches up with his place in basketball history.

Put together, this card links a top-three all-time player, the most important modern basketball parallel, very low print run, and a data-backed growth case. It speaks to collectors who grew up watching the skyhook and to investors who want a scarce, measurable asset with clear upside triggers.

The 2012 Prizm Gold 10/10 captures Kareem Abdul-Jabbar at the height of his legacy, paired with the most important modern basketball set of the last decade. With a 27.8% expected annual return, moderate volatility, and strong collector demand, it blends cultural relevance with clear financial potential for long-term investors.

Expert

K3Y Asset is a hobby platform to tell stories in the hobby of card collecting in proper contexts and often in parallel to sports history and moments, while unlocking desirable attributes from key sports cards to elevate them into long term desirable assets.