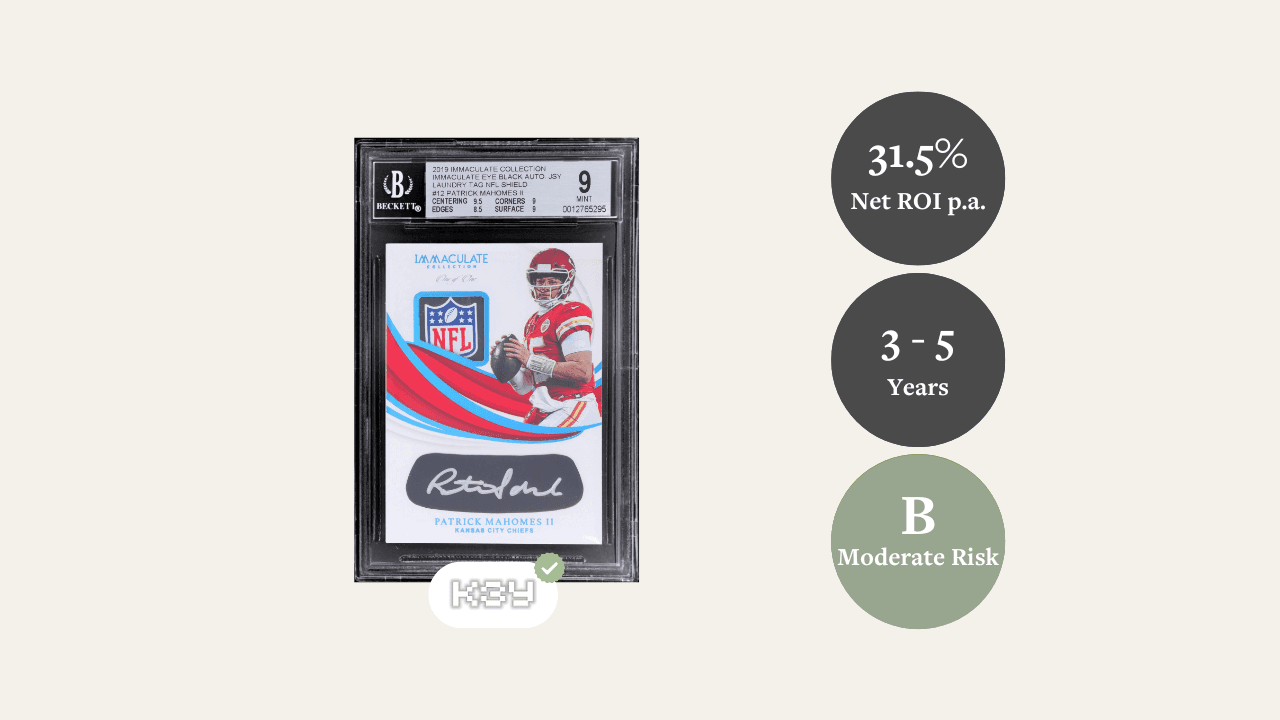

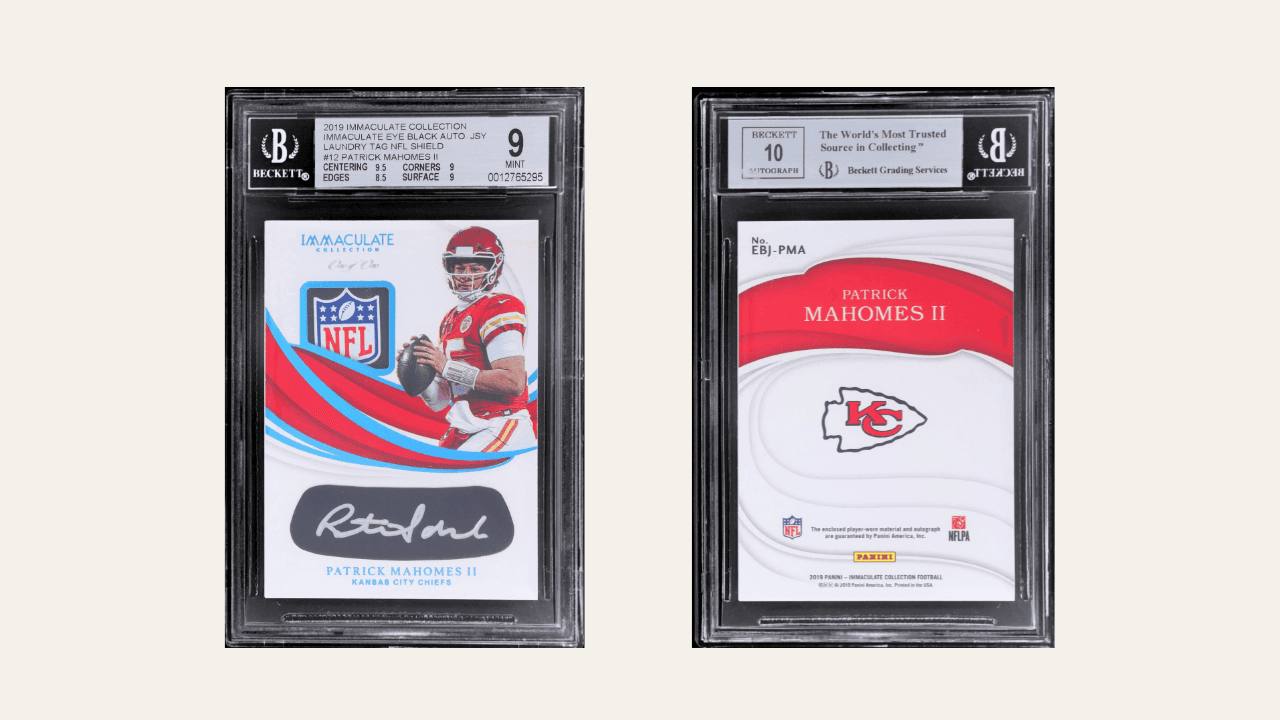

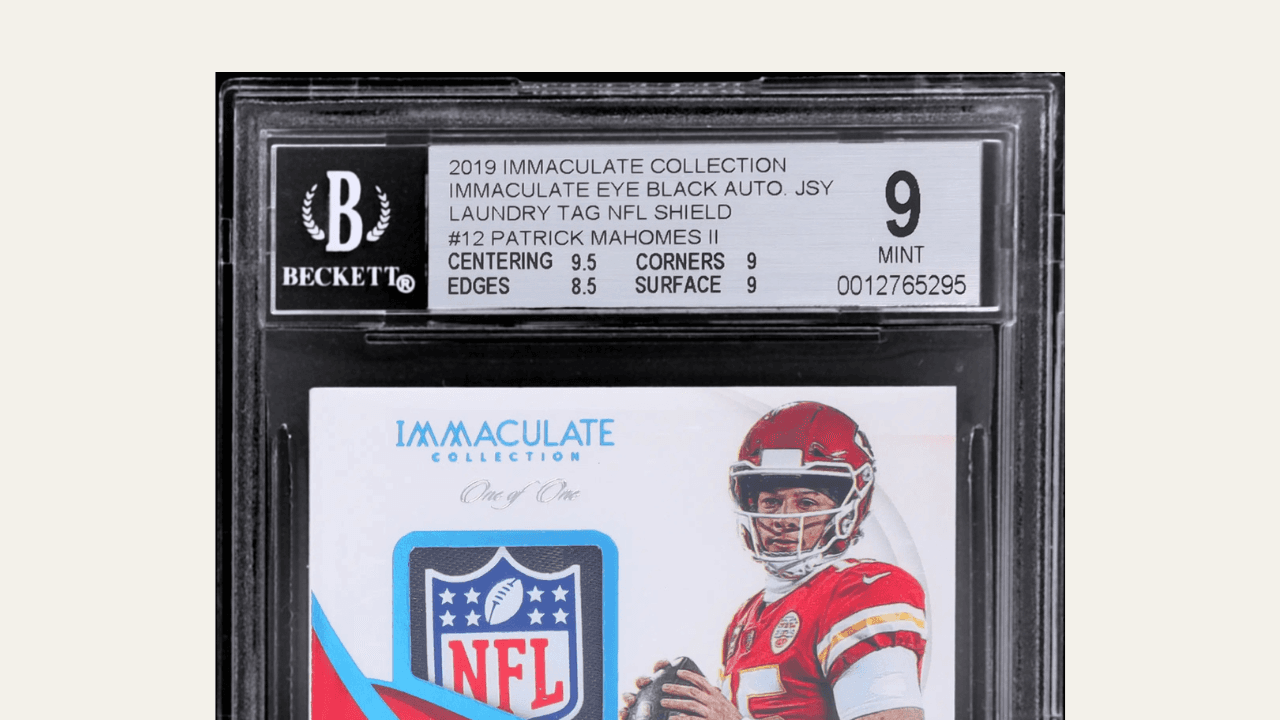

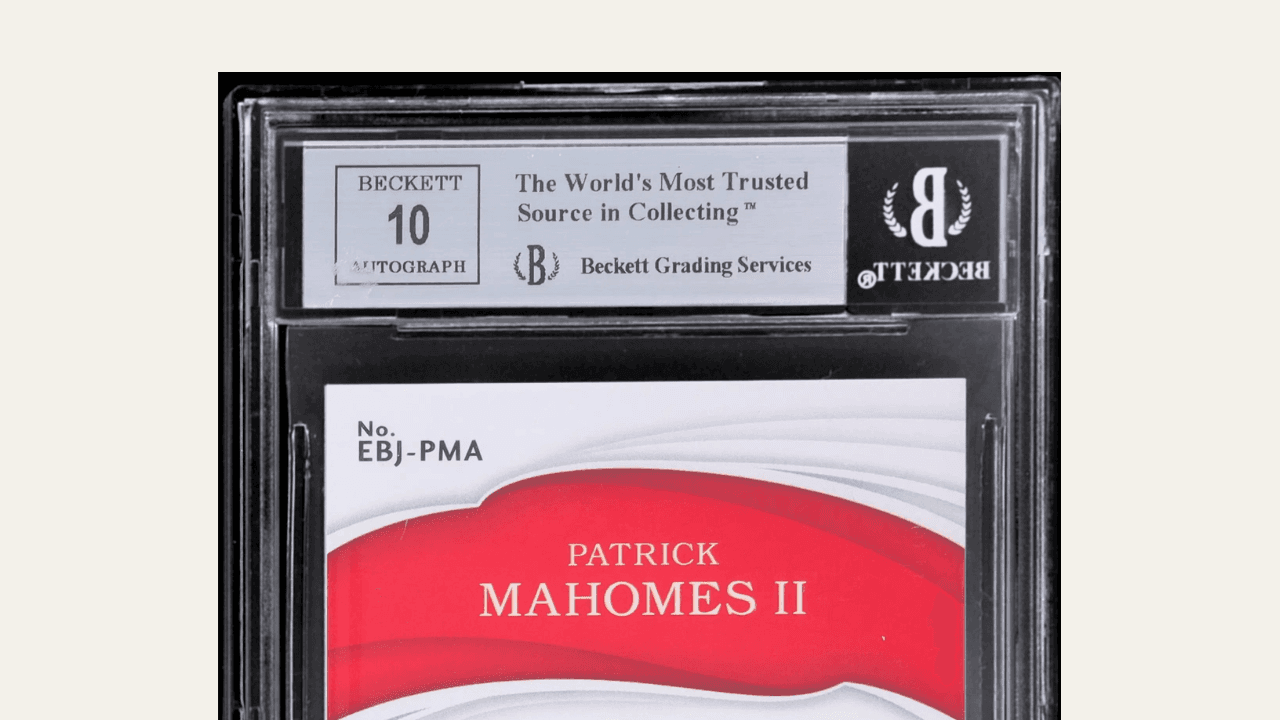

Patrick Mahomes, 2019 Immaculate Shield Auto 1/1, BGS 9 / Auto 10

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential: An investment of €500 could reach an estimated value of €1,970 in 5 years.

Cost-to-return ratio : After deducting 2.5% in annual total costs, your net return could reach 31.5% per year.

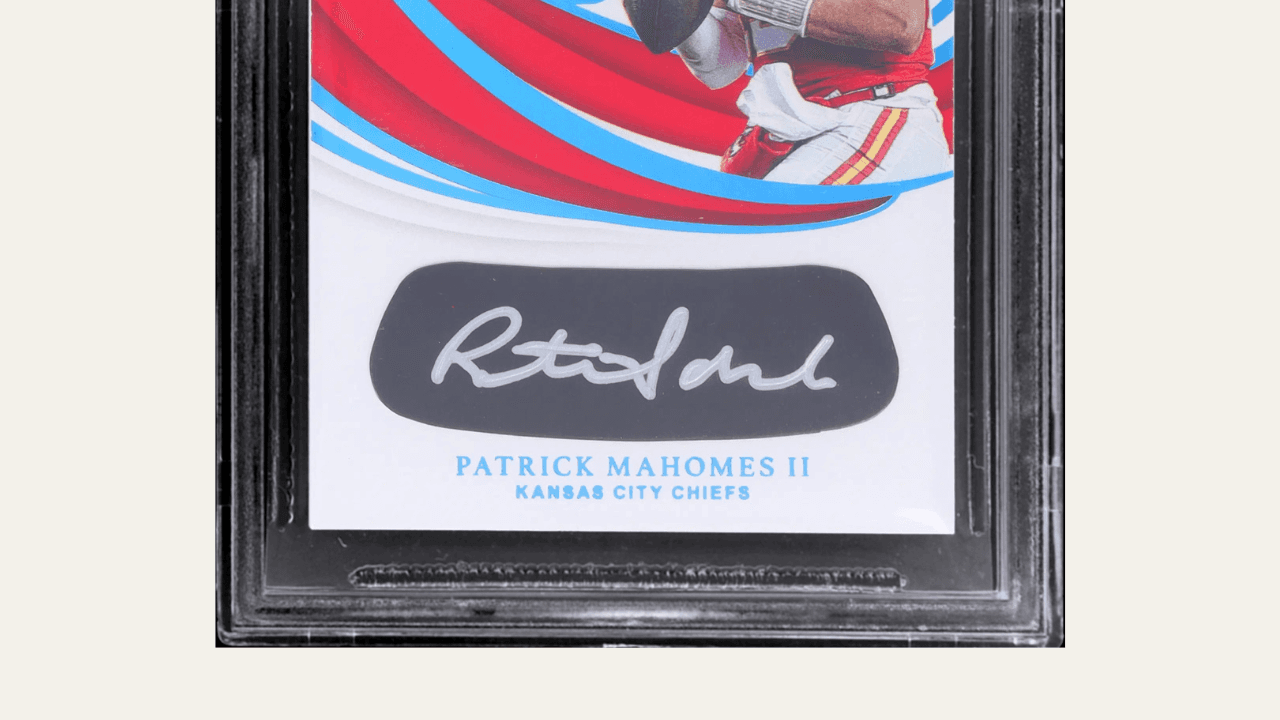

Mahomes’s defining 1/1 shield autograph: A one of one shield auto from Mahomes’s first championship season is a rare piece of sports history. The full signature, silver ink and vertical shield layout make it instantly iconic. With only one existing, this card captures a defining moment in modern football and offers investors a tangible share in Mahomes’s legacy.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 3 - 5 Years |

| Expected CAGR (Balanced) | 31.5% p.a. after fees |

| Ambitious CAGR | 45.2% p.a. after fees |

| Entry Basis | 0% vs. fair value |

| Sharpe Ratio | 0.99 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 94.1% chance to exceed €62,000 after 5 years |

| Standard Deviation | 32.5% |

| Risk Rating | B (8.4/10 - Moderate Risk) |

- 3–5 year horizon: Aligned with market cycles, peak demand windows and Fanatics’ takeover of NFL licensing.

- 31.5% CAGR (balanced): Based on achieving 80% of the observed 43.4% CAGR from the Mahomes Index (2020–2025).

- 45.2% CAGR (optimistic): Supported by early-career GOAT trajectory, shield scarcity and strong brand performance.

- 0% entry premium: The 56,000 EUR expert price matches transparent market benchmarks.

- Sharpe ratio 0.99: Strong risk-adjusted return relative to the SMI benchmark.

- 94.1% VaR threshold: High probability that the card exceeds the €62,000 value within five years.

- 32.5% standard deviation: Derived from the Patrick Mahomes general index dataset.

- Risk rating B: Moderate volatility with strong long-term upside based on brand, rarity and athlete trajectory.

Sports cards are an asset class that has enjoyed some of the highest multipliers in growth over the last 5 to 15 years among alternative investment vehicles. They combine powerful fundamentals: globally recognised licenses, age-tested brands, widespread passion for sports, and transcendent talents whose cultural impact drives sustained market demand. As the category continues to professionalise, premium assets tied to generational athletes show strong resilience and long-term appreciation.

This card brings together rarity, timing and cultural significance in a way that very few modern football collectibles can match. It is Patrick Mahomes’s only championship-year Immaculate Shield autograph presented in a vertical layout, featuring a full rookie-style signature and rare silver-ink inscription. For both collectors and investors, these combined traits elevate the card into the highest tier of one of ones in the modern era.

Shield autos already sit at the top of the hobby, but a one of one shield from Mahomes’s first Super Bowl winning season carries exceptional weight. The full signature — rarely seen in later releases — adds a personal, early-career touch that collectors value highly. The silver ink is another standout detail, appearing in only a select group of Mahomes cards, further distinguishing this piece even among elite assets.

Immaculate strengthens the investment case. As a top three premium patch-auto brand, it is known for consistent design, high-end materials and long-term market credibility. Many of the most valuable modern football sales originate from Immaculate or its sister line Exquisite, with collectors continuing to favour these brands when seeking investment-grade pieces.

The entry price is firmly supported by shield-auto comparables in Flawless and National Treasures, many of which trade between 40,000 and 60,000 EUR despite lacking the defining attributes present here. With stronger qualities and true one-of-one scarcity, this card sits on solid valuation footing.

Mahomes’s trajectory further reinforces conviction. Three championships, multiple MVPs and unmatched playoff performance create a clear, long-term GOAT storyline. With an expected balanced return of 31.5% per year and robust downside protection supported by VaR modelling, this asset represents a high-confidence opportunity built on rarity, provenance and measurable market demand.

This championship-year one of one shield auto captures the strongest blend of rarity, brand pedigree and GOAT-trajectory significance in the Mahomes market. With robust historical performance, a fully supported entry valuation and rising global demand for top-tier football grails, the card offers a compelling 3–5 year investment case.

Expert

K3Y Asset is a hobby platform to tell stories in the hobby of card collecting in proper contexts and often in parallel to sports history and moments, while unlocking desirable attributes from key sports cards to elevate them into long term desirable assets.