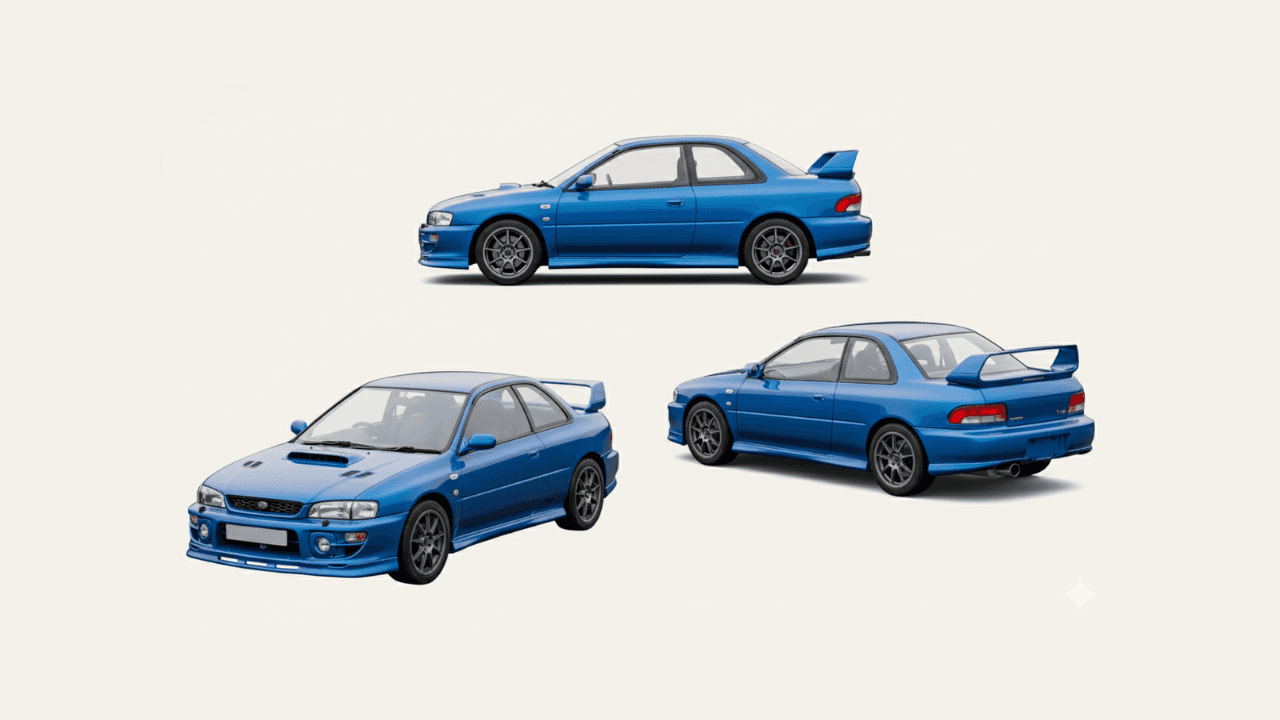

Subaru, Impreza P1, 2000

Buy the entire asset

Request to purchase the entire asset instead of just fractions.

Main reasons to invest

Return potential📈: An investment of €500 could reach an estimated value of €907 in 5 years.

Cost-to-return ratio⚖️: With 3.7% annual total costs, your net profit could be 12.7% per year.

The Spirit of rally lives On 🏁: Born from Subaru’s golden age of rally dominance, the Impreza P1 channels the energy of WRC legends into a road-legal masterpiece. It represents the peak of analogue performance before the digital era took over. This WR Package edition captures that spirit – rare, authentic, and increasingly coveted by investors and enthusiasts alike.

Description

| Metric | Value |

|---|---|

| Investment Horizon | 3–5 years |

| Expected CAGR (Balanced) | 12.7% p.a. after fees |

| Ambitious CAGR | 21.5% p.a. after fees |

| Entry Basis | ~6.8% vs. below fair value |

| Sharpe Ratio | 0.93 (vs. SMI: 0.61) |

| Value at Risk (VaR) | 96.7% chance to exceed €66,300 after 5 years |

| Standard Deviation | 14.9% |

| Risk Rating | A (8.8/10 - Low Risk) |

- 3 – 5 year horizon: Aligned with the appreciation cycle of limited-production Japanese performance cars, capturing both collector and investor demand.

- 12.7% CAGR (balanced): Based on 45% replication of the Japanese car index (2020–2025), consistent with the P1’s observed CAGR of 15.9%.

- 21.5% CAGR (optimistic): Reflects stronger global demand for JDM vehicles and rising scarcity of unmodified examples.

- ~6.8% entry discount: The purchase price of €66,300 sits below current market valuations, providing a favourable entry point.

- Sharpe Ratio of 0.93: Indicates a strong risk-adjusted return, outperforming the 5-year SMI benchmark (0.61).

- 96.7% VaR threshold: Suggests high probability of exceeding €66,300 after 5 years, reflecting reliable capital protection through scarcity and collector appeal.

- Standard deviation 14.9%: Represents moderate volatility typical for tangible collectibles with established global demand.

- Risk rating “A”: Classified as a low risk collectible with strong fundamentals, limited supply, and long-term appreciation potential.

Investing in classic and high-performance cars offers a blend of financial growth and tangible enjoyment. Unlike traditional assets, rare and iconic automobiles appreciate due to limited supply, historical significance, and growing collector demand. Cars provide portfolio diversification and act as a hedge against inflation. With strong auction results and increasing global interest, well-preserved models, particularly with unique specifications, continue to generate impressive returns while delivering an unmatched ownership experience.

The Subaru Impreza P1 is not only a collector’s dream but also a data-backed investment. Its appeal lies in combining motorsport heritage, limited production, and strong value retention – fundamentals that have driven consistent returns across the Japanese performance car segment. Designed by Prodrive, the same team that engineered Subaru’s rally dominance, the P1 represents a balance between historical significance and measurable financial performance.

The ultra-rare WR Package adds a further investment edge. It includes upgraded brakes, Prodrive Recaro seats, 18-inch wheels, a P1-specific exhaust, and Prodrive design mats. Features, that significantly enhance market value due to their scarcity and collectability. Only about one in eight P1s includes the complete bundle, which increases demand among both enthusiasts and investors.

This example’s fully original OEM condition, documented provenance, and only a single previous owner amplify its attractiveness. It has undergone a professional dry-ice underbody treatment to prevent corrosion, which is a rare level of preservation that ensures long-term protection and sustained liquidity.

Historically, cars like the Subaru P1 have shown reliable growth in the Japanese car index, which delivered a 36.7% CAGR between 2020 and 2025. With increasing collector demand and decreasing supply of unmodified examples, this asset is positioned for strong medium-term appreciation.

The Subaru Impreza P1 delivers a rare mix of heritage and investment strength. Its limited production, WR Package exclusivity, and impeccable condition make it a standout among collectible cars. With strong fundamentals, verified originality, and proven market demand, it’s not only a driver’s dream but also a promising investment opportunity.

Expert

The mission at TheCarCrowd is to give investors across the globe the opportunity to invest in one of the World’s fastest appreciating asset classes.